Mortgage Originator Jobs

The world of finance and real estate is a bustling industry with numerous career paths to explore. Among these, the role of a Mortgage Originator stands out as a pivotal position, playing a crucial role in the home buying process. In this comprehensive guide, we will delve deep into the world of Mortgage Originators, exploring their responsibilities, skills, and the rewarding career opportunities they offer.

Understanding the Role of a Mortgage Originator

A Mortgage Originator, also known as a Loan Officer or Mortgage Broker, is a professional who assists individuals and businesses in obtaining loans for purchasing or refinancing real estate. They are the bridge between borrowers and lenders, facilitating the entire loan process from application to approval.

The primary responsibility of a Mortgage Originator is to guide borrowers through the complex mortgage process, ensuring they secure the best loan terms for their needs. This involves a thorough understanding of various loan products, interest rates, and the ever-evolving landscape of the mortgage industry.

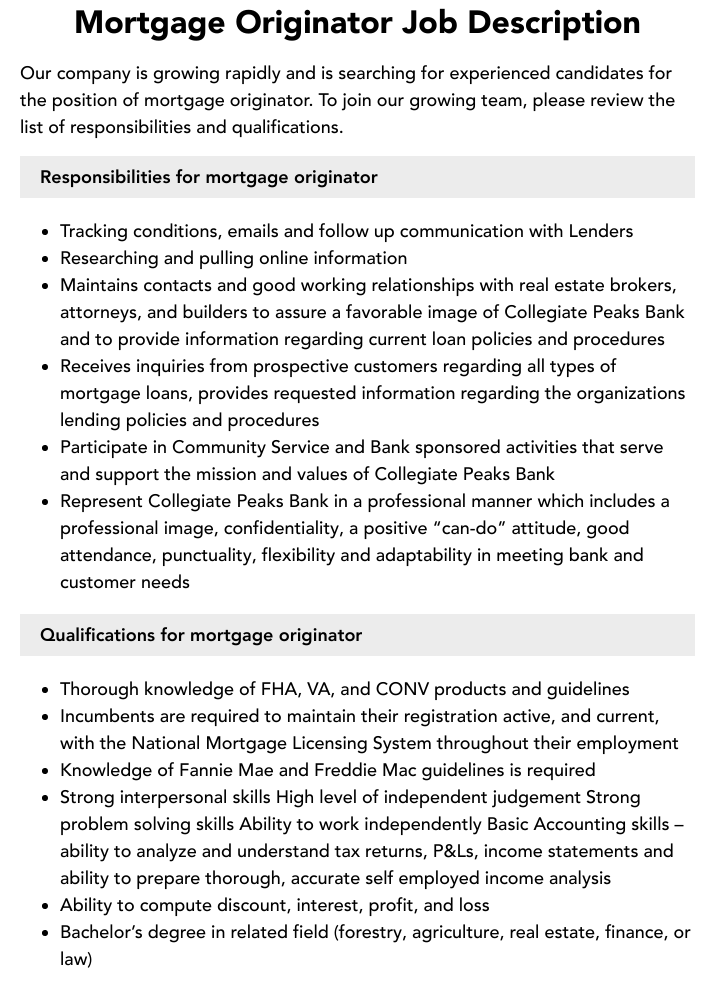

Key Responsibilities of a Mortgage Originator

- Conducting thorough loan interviews to understand the borrower’s financial situation and loan requirements.

- Assessing borrower eligibility by evaluating creditworthiness, income stability, and debt-to-income ratios.

- Matching borrowers with the most suitable loan products, including conventional, FHA, VA, and jumbo loans.

- Collecting and verifying necessary documentation, such as tax returns, bank statements, and employment records.

- Submitting loan applications to lenders and following up on any additional requirements or conditions.

- Communicating with borrowers throughout the process, providing regular updates, and addressing any concerns.

- Ensuring compliance with regulations and guidelines set by governing bodies like the Consumer Financial Protection Bureau (CFPB) and the Department of Housing and Urban Development (HUD).

Mortgage Originators often work with a wide range of clients, from first-time homebuyers to experienced investors, each with unique financial situations and loan needs. Their expertise lies in tailoring loan solutions to meet these diverse requirements, ensuring a seamless and stress-free experience for borrowers.

Skills and Qualifications Needed

The role of a Mortgage Originator demands a unique blend of skills and qualifications. Here’s an in-depth look at the essential competencies required to excel in this profession:

Financial Acumen

A deep understanding of financial principles is fundamental for Mortgage Originators. This includes knowledge of loan types, interest rates, and the impact of economic factors on the mortgage market. They must be adept at analyzing financial statements, credit reports, and tax documents to assess borrower eligibility accurately.

Communication and Interpersonal Skills

Mortgage Originators are often the primary point of contact for borrowers. Excellent communication skills are crucial to build trust and provide clear, concise explanations of complex loan processes. The ability to listen actively and address client concerns is essential for maintaining strong client relationships.

Attention to Detail

The mortgage process involves meticulous paperwork and documentation. Mortgage Originators must have an eye for detail to ensure all required documents are collected, verified, and submitted accurately. Even the smallest oversight can delay or disrupt the loan process.

Time Management and Organization

Mortgage Originators often juggle multiple loan applications simultaneously. Effective time management and organizational skills are vital to prioritize tasks, meet deadlines, and provide timely updates to borrowers and lenders.

Knowledge of Mortgage Regulations

The mortgage industry is heavily regulated, with rules and guidelines set by various governing bodies. Mortgage Originators must stay abreast of these regulations to ensure compliance and avoid legal pitfalls. This includes understanding loan disclosure requirements, anti-discrimination laws, and consumer protection regulations.

Problem-Solving Abilities

Mortgage transactions can be complex, and unexpected challenges may arise. Mortgage Originators must possess strong problem-solving skills to navigate these obstacles and find creative solutions to keep the loan process on track. This might involve working with borrowers to improve their creditworthiness or finding alternative loan products to meet their needs.

Technical Proficiency

In today’s digital age, Mortgage Originators must be comfortable with technology. This includes proficiency in using loan origination software, customer relationship management (CRM) tools, and secure document management systems. They should also have a basic understanding of data security practices to protect sensitive borrower information.

Career Opportunities and Growth

The mortgage industry offers a wealth of career opportunities for ambitious professionals. Here’s an overview of the potential career paths and growth prospects for Mortgage Originators:

Loan Officer

Loan Officers are the front-line professionals who interact directly with borrowers. They guide clients through the loan application process, collect and verify documentation, and ensure timely loan approvals. Loan Officers often specialize in specific loan types or work with a particular lender.

Mortgage Broker

Mortgage Brokers, also known as Mortgage Originators, work independently or with a brokerage firm. They have relationships with multiple lenders and can offer a wider range of loan products to borrowers. Mortgage Brokers are experts in matching borrowers with the best loan options, taking into account their unique financial circumstances.

Senior Loan Officer or Mortgage Broker

With experience and a proven track record of success, Mortgage Originators can advance to senior-level positions. Senior Loan Officers or Mortgage Brokers often have larger loan volumes, more complex transactions, and a higher level of autonomy. They may also mentor and train junior Loan Officers or Broker associates.

Mortgage Underwriter

Mortgage Underwriters review loan applications to determine their eligibility for approval. While not directly involved in the loan origination process, Mortgage Originators with a strong understanding of underwriting guidelines can transition into this role. Mortgage Underwriters play a critical role in ensuring that loans meet the lender’s risk criteria.

Loan Processing and Closing

Loan Processors and Closers handle the administrative tasks involved in the loan process. They prepare loan packages, ensure compliance with regulations, and coordinate with various parties to facilitate a smooth closing. Mortgage Originators with strong organizational skills and attention to detail can excel in these roles.

Mortgage Management and Leadership

Experienced Mortgage Originators with exceptional leadership skills can advance into management roles. They may oversee teams of Loan Officers, set strategic goals, and ensure the overall success of the mortgage business. Management positions often involve mentoring and developing junior team members, as well as building strong relationships with lenders and industry partners.

Performance Analysis and Success Metrics

In the competitive world of mortgage origination, performance analysis is key to gauging success and identifying areas for improvement. Here’s a closer look at the metrics used to evaluate Mortgage Originator performance:

Loan Volume and Value

The total number and dollar value of loans originated is a primary performance indicator. High loan volume and value demonstrate a Mortgage Originator’s ability to consistently attract and close deals.

Loan Approval Rate

The percentage of loans that are successfully approved and funded is a critical metric. A high approval rate indicates strong client selection and effective loan packaging, resulting in higher success rates with lenders.

Customer Satisfaction and Retention

Satisfied clients are the backbone of a successful Mortgage Originator career. Measuring customer satisfaction through surveys and feedback can provide valuable insights. High customer satisfaction and retention rates signify a Mortgage Originator’s ability to build strong relationships and deliver exceptional service.

Profitability and ROI

While loan volume is important, profitability is a key metric for long-term success. Mortgage Originators should strive to maintain a healthy balance between loan volume and profitability. Analyzing return on investment (ROI) can help identify the most lucrative loan products and client segments.

Compliance and Regulatory Adherence

Compliance with mortgage regulations is non-negotiable. Mortgage Originators must ensure that their processes and documentation meet all legal requirements. Regular audits and self-assessments can help identify areas of non-compliance and ensure continuous improvement.

Personal Production vs. Team Performance

For Mortgage Originators working in a team setting, analyzing personal production metrics alongside team performance is crucial. This allows for a balanced assessment, ensuring that individual contributions are recognized while also evaluating the overall team’s success.

Future Implications and Industry Trends

The mortgage industry is dynamic, with constant shifts in regulations, technology, and market conditions. Here’s a glimpse into the future and some key trends that will shape the role of Mortgage Originators:

Digital Transformation

The mortgage industry is embracing digital transformation, with an increasing focus on online loan applications, electronic documentation, and secure data management. Mortgage Originators will need to adapt to these technological advancements, leveraging digital tools to enhance efficiency and client experience.

Regulation and Compliance

Mortgage regulations are expected to remain stringent, with a continued focus on consumer protection and fair lending practices. Mortgage Originators must stay updated with regulatory changes and ensure their processes align with evolving guidelines.

Client Experience and Personalization

In a competitive market, providing an exceptional client experience is paramount. Mortgage Originators will need to focus on personalization, tailoring loan solutions to meet individual borrower needs. Building strong relationships and offering proactive support can set Mortgage Originators apart from their competitors.

Alternative Loan Products

As the market evolves, alternative loan products may gain traction. Mortgage Originators should stay informed about emerging loan options, such as crowd-funding, peer-to-peer lending, or innovative mortgage structures. Offering a diverse range of loan products can attract a wider client base.

Data-Driven Decision Making

Big data and analytics will play an increasingly important role in the mortgage industry. Mortgage Originators who leverage data-driven insights to inform their loan strategies and client recommendations will have a competitive edge. Analyzing market trends and borrower behavior can lead to more accurate loan forecasting and improved decision-making.

Conclusion

The role of a Mortgage Originator is both challenging and rewarding, offering a unique blend of financial expertise and client interaction. With the right skills, qualifications, and a commitment to continuous learning, Mortgage Originators can forge successful careers in this dynamic industry. As the mortgage landscape evolves, staying adaptable and proactive will be key to long-term success.

What qualifications do I need to become a Mortgage Originator?

+The qualifications required to become a Mortgage Originator can vary by state and country. Generally, you’ll need a high school diploma or equivalent, and many lenders or brokerage firms prefer candidates with a bachelor’s degree in a related field such as finance, economics, or business. Additionally, you’ll need to obtain the necessary licenses and certifications specific to your jurisdiction. These often involve completing pre-licensing education courses and passing exams to demonstrate your knowledge of mortgage regulations and practices.

How long does it take to become a Mortgage Originator?

+The timeline to become a Mortgage Originator can vary depending on several factors. Typically, it involves completing the necessary education and training, which can take several months to a year. This includes studying for and passing the required licensing exams. Additionally, gaining practical experience through an apprenticeship or entry-level position can further enhance your skills and knowledge. On average, it can take anywhere from 6 months to 2 years to become fully licensed and establish yourself as a Mortgage Originator.

What are the earning potential and career prospects for Mortgage Originators?

+The earning potential for Mortgage Originators can be quite lucrative, often based on a combination of salary and commission or bonuses. While entry-level positions may offer a fixed salary, experienced Mortgage Originators often work on a commission basis, earning a percentage of the loans they originate. The income potential can vary widely, with top performers earning six-figure salaries. Career prospects are generally positive, with a steady demand for mortgage professionals. However, success in this field often depends on building a strong network, developing expertise, and staying updated with industry trends.