Mortgage Jobs

The mortgage industry is a dynamic and integral part of the global financial landscape, offering a range of career opportunities for professionals with diverse skill sets. From loan origination to underwriting and servicing, the mortgage job market provides a fascinating glimpse into the intricate world of finance and real estate.

The Role of a Mortgage Professional

Mortgage professionals play a crucial role in facilitating homeownership and real estate investment. They are responsible for guiding individuals and businesses through the complex process of obtaining financing for property purchases or refinances. This involves a deep understanding of financial markets, real estate trends, and the ever-evolving regulatory landscape.

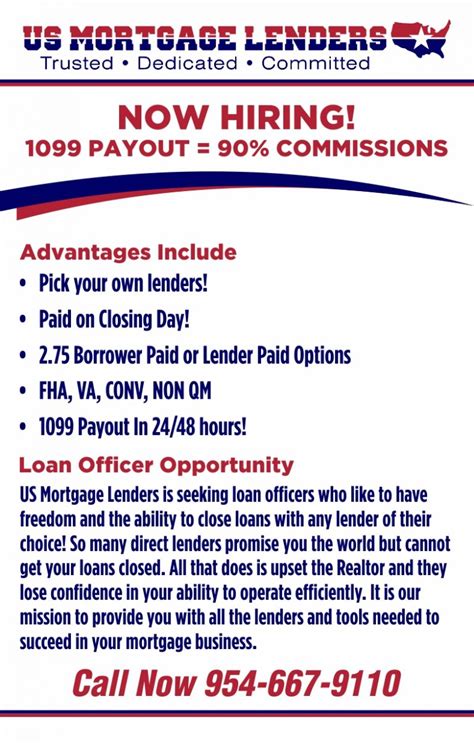

One of the primary roles within the mortgage industry is that of a Loan Officer or Mortgage Broker. These professionals are the first point of contact for borrowers, providing expert advice on loan products, rates, and terms. They assess a borrower's financial situation, income, and credit history to recommend suitable loan options. Loan officers also assist in gathering necessary documentation, such as tax returns, pay stubs, and bank statements, to support the loan application.

Underwriting: The Art of Risk Assessment

Once a loan application is submitted, it undergoes a rigorous evaluation process known as underwriting. Underwriters are the gatekeepers of the mortgage process, responsible for assessing the risk associated with each loan. They meticulously review the borrower’s financial profile, property details, and market conditions to determine the loan’s eligibility and terms.

Underwriters consider various factors, including the borrower's credit score, debt-to-income ratio, employment history, and the property's value and condition. They use sophisticated tools and software to analyze this data, ensuring that the loan meets the lender's guidelines and complies with regulatory requirements. The underwriter's decision can significantly impact the borrower's experience, determining whether they qualify for the loan and at what interest rate.

| Loan Type | Average Interest Rate (%) |

|---|---|

| Conventional Fixed-Rate | 4.5 - 5.0 |

| Adjustable-Rate Mortgages (ARM) | 3.5 - 4.0 |

| Government-Backed Loans (FHA, VA) | 3.0 - 3.5 |

Note: Interest rates are subject to change based on market conditions and borrower profiles.

Loan Servicing: A Long-Term Commitment

After a loan is funded, it enters the servicing phase. Loan servicers are responsible for the ongoing management of the loan, ensuring timely payments and proper escrow account administration. They communicate regularly with borrowers, providing statements, collecting payments, and addressing any issues or concerns.

Loan servicers also play a critical role in default management. They work closely with borrowers who are facing financial difficulties, offering solutions such as loan modifications, forbearance, or repayment plans to help them stay in their homes. Effective loan servicing not only protects the lender's interests but also contributes to the overall financial well-being of borrowers.

Skills and Qualifications for Mortgage Professionals

A successful career in the mortgage industry requires a unique blend of financial acumen, interpersonal skills, and technical expertise. Here are some key skills and qualifications that mortgage professionals often possess:

- Financial Knowledge: A deep understanding of financial concepts, including interest rates, loan terms, and market trends, is essential.

- Communication Skills: Excellent verbal and written communication abilities are crucial for building trust with borrowers and colleagues.

- Attention to Detail: The ability to review and analyze complex financial documents and identify potential issues is vital.

- Compliance Expertise: Knowledge of regulatory requirements and compliance standards is essential to ensure legal and ethical practices.

- Technology Proficiency: Familiarity with loan origination software, underwriting tools, and data management systems is becoming increasingly important.

Education and Training

Mortgage professionals typically hold a bachelor’s degree in finance, economics, or a related field. However, the industry also values practical experience and ongoing professional development. Many mortgage companies offer comprehensive training programs to help new hires understand the intricacies of the business.

Additionally, mortgage professionals often pursue certifications to enhance their credentials. The Certified Mortgage Banker (CMB) designation, offered by the Mortgage Bankers Association (MBA), is a highly regarded certification that demonstrates expertise in the industry. Other certifications, such as the Certified Residential Mortgage Specialist (CRMS) and the Certified Mortgage Underwriter (CMU), focus on specific roles within the mortgage process.

The Future of Mortgage Jobs

The mortgage industry is evolving rapidly, driven by technological advancements and changing market dynamics. The rise of digital lending platforms and online mortgage applications has transformed the way loans are originated and processed. As a result, mortgage professionals are increasingly adopting a hybrid role, combining traditional interpersonal skills with technological proficiency.

Looking ahead, the industry is expected to continue its digital transformation, with a focus on streamlining processes and enhancing the borrower experience. This presents both challenges and opportunities for mortgage professionals, requiring them to stay adaptable and embrace new technologies. Additionally, the industry's focus on compliance and regulatory adherence is likely to remain a key priority, ensuring a stable and secure lending environment.

The Impact of Economic Cycles

Mortgage professionals must also navigate the ups and downs of economic cycles. During periods of economic growth and low interest rates, the mortgage industry tends to experience higher loan volumes and increased demand for refinancing. Conversely, economic downturns and rising interest rates can lead to a slowdown in loan activity and increased challenges for borrowers and lenders alike.

The ability to adapt to changing market conditions and provide tailored solutions to borrowers is crucial for long-term success in the mortgage industry. Mortgage professionals must stay informed about economic trends, real estate market dynamics, and policy changes to offer the most relevant and beneficial advice to their clients.

Conclusion

The mortgage industry offers a rewarding career path for individuals passionate about finance, real estate, and helping others achieve their homeownership dreams. With a diverse range of roles and the opportunity to make a meaningful impact, the mortgage job market provides a unique and challenging professional journey. Whether it’s originating loans, assessing risks, or servicing existing mortgages, mortgage professionals play a vital role in the financial ecosystem.

As the industry continues to evolve, embracing technological advancements and adapting to economic cycles, the demand for skilled mortgage professionals is likely to remain strong. By staying informed, continuously learning, and embracing innovation, mortgage professionals can thrive in this dynamic and exciting field.

What is the average salary for mortgage professionals?

+Salaries in the mortgage industry can vary widely based on factors such as role, experience, and geographic location. Loan officers often work on a commission basis, with earnings dependent on the volume and complexity of loans originated. Underwriters and loan servicers typically earn a base salary, with potential for bonuses and incentives. According to recent data, the median annual salary for loan officers is around 63,000, while underwriters and loan servicers can expect median salaries of 55,000 and $48,000 respectively.

How can I break into the mortgage industry with no prior experience?

+Breaking into the mortgage industry without prior experience is certainly possible. Many companies offer entry-level positions and comprehensive training programs to help new hires develop the necessary skills. Consider applying for positions such as loan officer assistant or loan processor, which often provide valuable insights into the industry. Additionally, pursuing relevant certifications and networking within the industry can significantly enhance your chances of success.

What are the key challenges faced by mortgage professionals today?

+Mortgage professionals face a range of challenges, including navigating complex regulatory environments, adapting to rapidly changing market conditions, and managing borrower expectations. Additionally, the industry’s increasing focus on technology and digital transformation requires professionals to stay up-to-date with the latest tools and platforms. Balancing the traditional interpersonal skills with technological proficiency is a key challenge for many mortgage professionals.