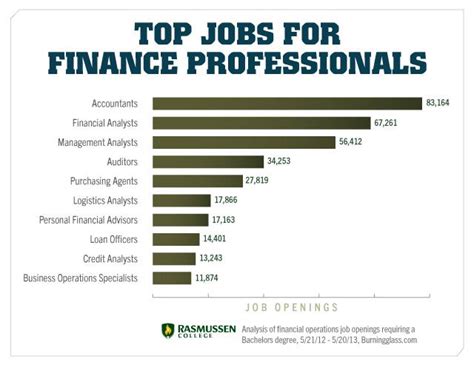

Jobs With A Finance Degree

A finance degree is a versatile qualification that opens doors to a wide range of career opportunities. Whether you're passionate about numbers, fascinated by the world of investments, or interested in the intricacies of financial management, a finance degree can serve as a solid foundation for a rewarding and diverse career path. In this comprehensive guide, we will delve into the myriad of job options available to finance degree holders, exploring the specific roles, skills, and industries that offer the most promising prospects.

Exploring Career Paths with a Finance Degree

The beauty of a finance degree lies in its adaptability, as it equips individuals with a strong understanding of financial principles and practices that are applicable across various sectors. From corporate finance to investment banking and from risk management to financial planning, the choices are abundant. Let’s delve into some of the most prominent career paths that await finance graduates.

Corporate Finance

Corporate finance professionals play a crucial role in shaping a company’s financial strategy and ensuring its long-term success. This field involves a range of responsibilities, including financial planning, budgeting, and forecasting. Finance graduates with an aptitude for analysis and strategic thinking often thrive in these roles, where they contribute to key decision-making processes and help drive organizational growth.

One of the primary tasks in corporate finance is developing and implementing financial models that guide a company's investment decisions. These models take into account various factors such as market trends, economic conditions, and internal resource allocation. By analyzing these models, finance professionals can advise senior management on the most profitable courses of action, helping the company stay competitive and achieve its financial goals.

| Role | Description |

|---|---|

| Financial Analyst | Conducts financial research, prepares reports, and provides insights to support decision-making. |

| Treasury Manager | Manages cash flow, oversees investments, and ensures the company's financial health. |

| Controller | Handles accounting operations, financial reporting, and internal controls. |

Investment Banking

Investment banking is an exciting and fast-paced field that offers finance graduates the opportunity to work on high-profile deals and transactions. Investment bankers act as intermediaries between companies and investors, facilitating mergers and acquisitions, initial public offerings (IPOs), and other financial activities. The role requires a deep understanding of financial markets, valuation techniques, and risk assessment.

One of the key responsibilities in investment banking is providing financial advice to clients, which may include large corporations, governments, or even high-net-worth individuals. This advice covers a range of areas, such as raising capital, structuring deals, and managing investments. Investment bankers must stay abreast of market trends and regulatory changes to ensure their clients receive the most accurate and up-to-date guidance.

| Role | Description |

|---|---|

| Investment Banking Analyst | Assists in financial modeling, valuation, and due diligence for various transactions. |

| M&A Specialist | Specializes in merger and acquisition deals, negotiating terms and structuring agreements. |

| Equity Research Analyst | Conducts research and provides insights on specific industries or companies to support investment decisions. |

Risk Management

Risk management is a critical function in any financial institution, and finance graduates with a keen eye for detail and a systematic approach often excel in this field. Risk managers are responsible for identifying, assessing, and mitigating various financial risks, ensuring that organizations operate within a controlled and compliant framework.

The role involves analyzing complex data sets, developing risk models, and implementing strategies to minimize potential losses. Risk managers must stay updated on industry trends and regulatory changes to ensure their risk management practices remain effective and aligned with best practices. They collaborate closely with various departments, providing insights and recommendations to support decision-making processes.

| Role | Description |

|---|---|

| Risk Analyst | Conducts risk assessments, develops risk mitigation plans, and monitors risk exposure. |

| Credit Risk Manager | Focuses on credit risk, assessing borrower's creditworthiness and managing loan portfolios. |

| Compliance Officer | Ensures the organization complies with all relevant financial regulations and industry standards. |

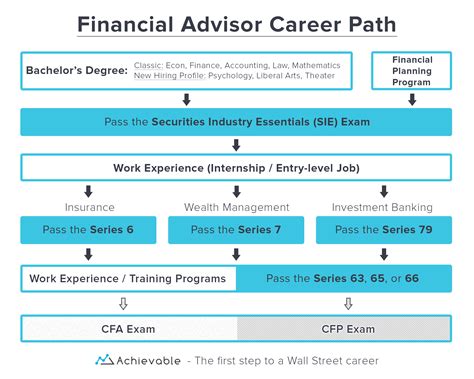

Financial Planning and Wealth Management

Financial planning and wealth management professionals work closely with individuals and families to help them achieve their financial goals. This field requires a strong understanding of investment strategies, tax planning, and estate planning. Finance graduates with excellent communication skills and a passion for helping others can thrive in these client-centric roles.

Financial planners often work with clients to develop personalized financial plans, taking into account their income, assets, and future goals. These plans may include investment strategies, retirement planning, and tax optimization. Wealth managers, on the other hand, focus on high-net-worth individuals, offering comprehensive financial solutions to manage and grow their wealth.

| Role | Description |

|---|---|

| Financial Planner | Develops financial plans, provides investment advice, and helps clients achieve their financial goals. |

| Wealth Manager | Manages the financial affairs of high-net-worth individuals, offering comprehensive wealth management solutions. |

| Retirement Specialist | Specializes in retirement planning, helping individuals prepare for their financial future post-retirement. |

Skills and Specializations for Success

While a finance degree provides a strong foundation, certain skills and specializations can further enhance a graduate’s career prospects. Here are some key areas to consider:

- Quantitative Skills: Finance professionals with strong quantitative skills, including advanced Excel proficiency, programming languages (Python, R), and statistical analysis, are highly valued in the industry.

- Data Analytics: The ability to interpret and analyze large datasets is becoming increasingly important. Finance graduates with data analytics skills can contribute to informed decision-making and strategic planning.

- Financial Modeling: Proficiency in building and interpreting financial models is essential for many finance roles. This skill allows professionals to forecast financial outcomes, assess risks, and support investment decisions.

- Communication and Interpersonal Skills: Effective communication is crucial in finance, whether it's presenting complex financial concepts to colleagues or clients, negotiating deals, or building relationships with stakeholders.

- Industry-Specific Knowledge: Gaining expertise in a specific industry, such as healthcare, technology, or energy, can be a significant advantage. Understanding industry-specific financial considerations allows professionals to provide more tailored solutions.

Industry Insights and Future Opportunities

The financial industry is dynamic and constantly evolving, presenting a range of exciting opportunities for finance graduates. Here’s a glimpse into some emerging trends and industries that are shaping the future of finance careers.

Fintech and Digital Innovation

The rise of fintech has revolutionized the financial industry, bringing about a wave of digital innovation. Finance graduates with an interest in technology can explore roles in areas like blockchain, cryptocurrency, and artificial intelligence. These fields offer opportunities to develop cutting-edge financial solutions and drive digital transformation.

For instance, blockchain technology is transforming traditional financial processes, such as payments, settlements, and record-keeping. Finance professionals with an understanding of blockchain can contribute to the development of secure and efficient financial systems, opening up new avenues for career growth.

Sustainable and Impact Investing

The growing focus on sustainability and social impact has led to the emergence of sustainable investing and impact investing. Finance graduates with a passion for environmental and social causes can pursue careers in these fields, where they can help allocate capital towards projects and companies that promote positive change.

Sustainable investing involves considering environmental, social, and governance (ESG) factors in investment decisions. Impact investing, on the other hand, aims to generate measurable social and environmental impact alongside financial returns. These fields offer a unique blend of finance and social responsibility, providing a rewarding career path for those with a purpose-driven mindset.

Global Financial Markets

The financial industry is inherently global, and finance graduates with an international outlook can explore careers in global financial markets. Whether it’s working for multinational corporations, investment banks with a global presence, or international organizations, there are ample opportunities to engage with diverse markets and cultures.

For instance, finance professionals can specialize in international banking, providing financial services to clients across borders. They can also work in global investment management, helping institutions navigate the complexities of international markets and optimize their investment strategies.

Regulatory and Compliance Roles

With the ever-increasing complexity of financial regulations, there is a growing demand for professionals who specialize in compliance and regulatory affairs. Finance graduates with an interest in this area can pursue careers in roles such as compliance officers, regulatory analysts, or legal and compliance advisors.

These professionals ensure that financial institutions and individuals adhere to the latest regulatory standards, helping to mitigate risks and maintain the integrity of the financial system. The field requires a deep understanding of financial regulations, legal frameworks, and ethical practices.

Conclusion

A finance degree opens up a world of possibilities, offering a diverse range of career paths in an industry that is both challenging and rewarding. From corporate finance to investment banking, risk management to financial planning, finance graduates can leverage their skills and expertise to make a significant impact in the world of finance.

As the financial industry continues to evolve, the demand for skilled and adaptable professionals remains high. By staying updated on industry trends, honing their skills, and pursuing specialized knowledge, finance graduates can position themselves for long-term success and contribute to the dynamic world of finance.

What are the key skills needed for a career in finance?

+A successful career in finance often requires a combination of strong analytical skills, quantitative abilities, and excellent communication skills. Professionals in finance need to be able to interpret complex data, build financial models, and present their findings to stakeholders. Additionally, a solid understanding of financial regulations and compliance frameworks is crucial.

How can I enhance my career prospects with a finance degree?

+To enhance your career prospects, consider gaining industry-specific knowledge and skills. This could involve pursuing certifications like the CFA, FRM, or CPM (Certified Public Accountant), which demonstrate expertise in specific areas of finance. Additionally, developing a strong network and building relationships within the industry can open doors to new opportunities.

What are some emerging trends in the finance industry?

+The finance industry is witnessing a surge in digital innovation, with fintech and blockchain technology leading the way. Additionally, sustainable and impact investing is gaining momentum, offering finance professionals a chance to contribute to positive social and environmental change. These emerging trends present exciting opportunities for those with a forward-thinking mindset.