Jobs At Venture Capital Firms

Unlocking Career Opportunities in Venture Capital: A Comprehensive Guide

The world of venture capital (VC) is an exciting and dynamic field, offering a range of career opportunities for those passionate about innovation, entrepreneurship, and making a lasting impact on the business landscape. In this guide, we will explore the diverse roles available within venture capital firms, shedding light on the skills, qualifications, and pathways to success in this thriving industry.

Venture capital is an essential driver of economic growth, providing vital funding and support to innovative startups and emerging businesses. As a result, VC firms are hubs of creativity, strategic thinking, and high-level business acumen. For individuals seeking a challenging and rewarding career, the venture capital sector presents an array of options, each contributing to the overall mission of fostering groundbreaking ideas and shaping the future of industries.

Understanding the Venture Capital Landscape

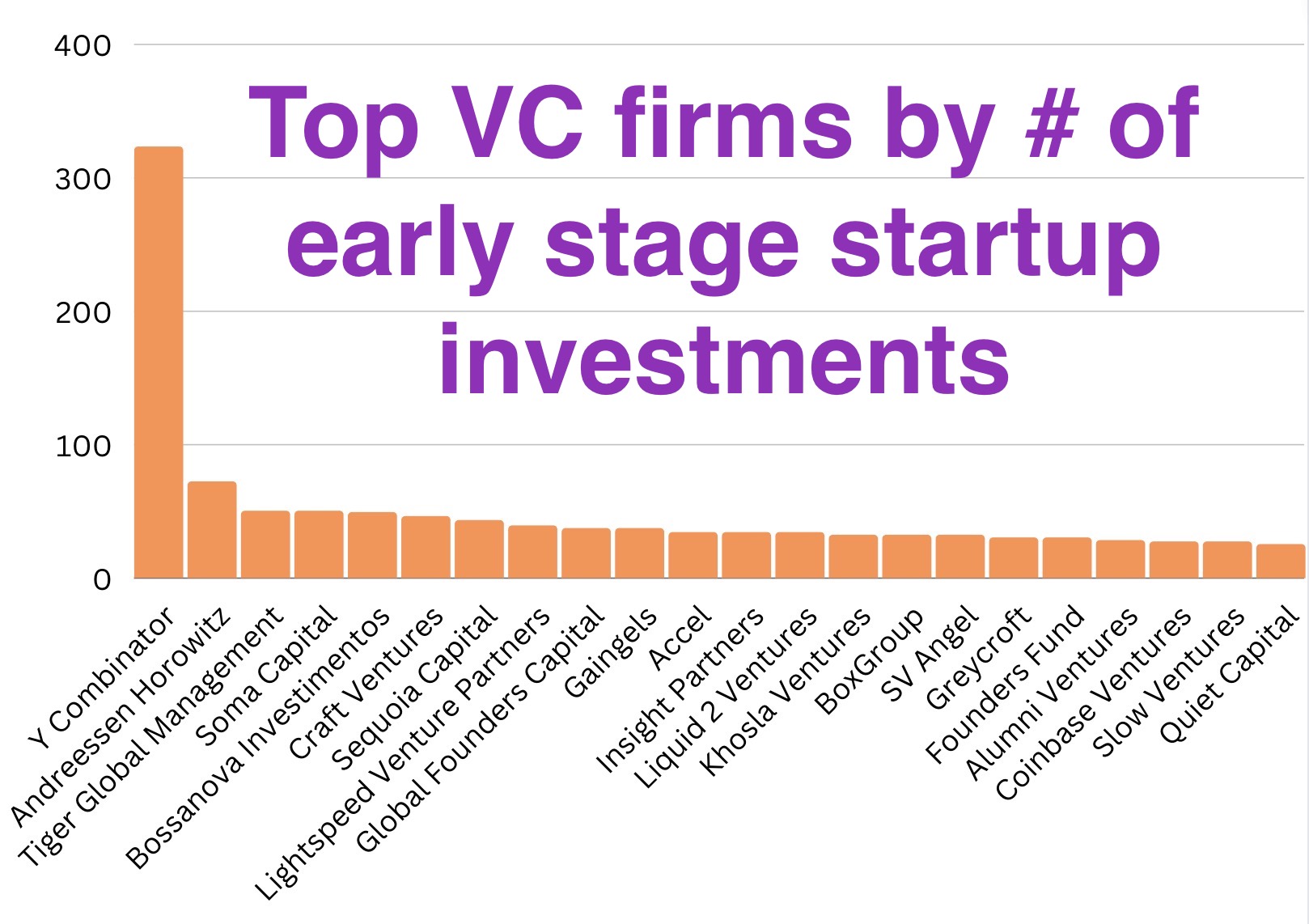

Before diving into the specific roles and opportunities, it's crucial to grasp the fundamentals of the venture capital industry. At its core, venture capital involves investing in early-stage, high-potential companies with the aim of nurturing their growth and ultimately realizing significant financial returns. VC firms play a pivotal role in this process, acting as catalysts for innovation and growth.

The VC industry is characterized by a unique blend of financial expertise, strategic insight, and a deep understanding of emerging markets and technologies. Firms often focus on specific sectors or stages of development, such as early-stage startups, growth-stage companies, or niche industries like biotechnology or clean energy. This specialization allows VC professionals to become experts in their chosen fields, guiding portfolio companies through the complex journey of scaling their businesses.

The Diverse Roles within Venture Capital Firms

Within the venture capital ecosystem, a multitude of roles exist, each contributing to the overall success of the firm and its portfolio companies. Let's delve into some of the key positions and the impact they have on the industry.

Investment Professionals

Investment professionals are the backbone of any VC firm. These individuals are responsible for identifying, evaluating, and executing investment opportunities. The role typically involves conducting extensive research, analyzing market trends, and assessing the potential of startup companies.

- Investment Analysts: These professionals often serve as the first line of defense in the investment process. They conduct initial screenings of potential investment opportunities, gathering data, performing financial analyses, and providing recommendations to senior investment team members.

- Associates: Associates are typically involved in the entire investment lifecycle, from sourcing deals to post-investment monitoring. They assist in due diligence, financial modeling, and drafting investment memos, often working closely with senior team members to refine their skills and gain exposure to the investment process.

- Principals and Partners: As the senior-most investment professionals, principals and partners are responsible for making final investment decisions. They lead deal negotiations, oversee portfolio company management, and provide strategic guidance to the firm's investments. Principals and partners often have extensive industry experience and a deep network of connections, leveraging their expertise to drive the firm's investment strategy.

Portfolio Management and Support

While investment professionals focus on identifying and executing deals, the success of a VC firm's portfolio companies often relies on dedicated support and management functions. These roles are crucial for ensuring that portfolio companies have the resources and guidance needed to thrive.

- Portfolio Managers: Portfolio managers play a critical role in nurturing the firm's investments. They work closely with portfolio company management teams, providing strategic advice, assisting with operational challenges, and helping to navigate growth opportunities. Portfolio managers often have extensive industry experience and a deep understanding of the specific sectors in which the firm invests.

- Business Development Managers: These professionals are responsible for identifying and pursuing strategic partnerships and growth opportunities for portfolio companies. They build and maintain relationships with potential customers, industry influencers, and strategic partners, helping to expand the company's reach and market presence.

- Operations and Support Staff: Behind every successful VC firm is a dedicated operations team. These professionals handle a range of functions, including financial reporting, legal and compliance matters, HR management, and administrative support. They ensure that the firm's back-office operations run smoothly, allowing investment professionals to focus on deal sourcing and portfolio management.

The Entrepreneurial Support Ecosystem

Venture capital firms are not just investors; they are also catalysts for entrepreneurial success. Many VC firms go beyond financial contributions, providing a range of support services to help portfolio companies thrive.

- Entrepreneur-in-Residence (EIR): EIRs are experienced entrepreneurs who work within VC firms to mentor and guide portfolio company founders. They bring their firsthand experience and insights to the table, helping founders navigate the challenges of building and scaling a business. EIRs often play a crucial role in shaping the firm's investment strategy and identifying potential investment opportunities.

- Industry Experts and Advisors: VC firms often engage industry experts and advisors to provide specialized knowledge and strategic guidance to portfolio companies. These individuals bring deep domain expertise, helping companies navigate complex industry landscapes and make informed business decisions. Advisors may offer guidance on product development, market positioning, or operational efficiency, among other areas.

- Incubation and Acceleration Programs: Some VC firms operate incubation or acceleration programs, providing a supportive environment for early-stage startups to develop and grow. These programs offer a range of resources, including mentorship, office space, networking opportunities, and access to funding. Incubation and acceleration programs play a vital role in nurturing the next generation of innovative companies and fostering a vibrant startup ecosystem.

Qualifications and Skills for a Career in Venture Capital

The venture capital industry demands a unique blend of skills and qualifications. While specific requirements may vary depending on the role and the firm, there are several key competencies that are highly valued across the board.

Education and Background

A strong academic background is often a prerequisite for a career in venture capital. Many VC professionals hold advanced degrees, such as MBAs or postgraduate qualifications in finance, economics, or business. However, it's important to note that a degree alone is not sufficient; relevant work experience and a track record of success are equally crucial.

While a finance or business background is common, individuals with diverse educational backgrounds can also find success in the VC industry. Engineers, scientists, and technology experts, for example, bring valuable industry insights and a deep understanding of emerging technologies. Similarly, professionals with legal, accounting, or operational backgrounds can contribute unique skill sets to VC firms.

Key Skills and Competencies

- Analytical and Quantitative Skills: The ability to analyze complex data, perform financial modeling, and make data-driven decisions is essential in venture capital. Investment professionals must be adept at assessing market trends, evaluating financial metrics, and forecasting potential returns.

- Strategic Thinking and Business Acumen: VC professionals need to possess a deep understanding of business dynamics and market forces. They must be able to identify growth opportunities, assess competitive landscapes, and develop strategic plans to drive portfolio company success.

- Networking and Relationship Building: Venture capital is a highly interconnected industry. Building and maintaining relationships with entrepreneurs, industry experts, and potential partners is crucial for deal sourcing and portfolio company support. Strong networking skills and a genuine interest in connecting with people are highly valued.

- Communication and Presentation Skills: Effective communication is key in VC. Professionals must be able to convey complex ideas and investment opportunities clearly and persuasively. Strong presentation skills are essential for pitching investment ideas to partners, entrepreneurs, and potential investors.

- Industry Knowledge and Expertise: A deep understanding of specific industries or sectors is highly advantageous in the VC world. Professionals who bring industry-specific knowledge and networks can provide unique value to the firm and its portfolio companies.

- Critical Thinking and Problem-Solving: The ability to think critically, identify problems, and develop innovative solutions is essential in venture capital. Professionals must be able to navigate complex business challenges and find creative ways to drive growth and success.

The Path to a Career in Venture Capital

Breaking into the venture capital industry can be a challenging yet rewarding journey. Here are some key steps and considerations for those aspiring to build a career in VC.

Gaining Relevant Experience

Venture capital firms often seek candidates with a strong track record of success and relevant industry experience. Here are some ways to gain valuable experience:

- Investment Banking or Private Equity: Many VC professionals begin their careers in investment banking or private equity. These industries provide valuable financial and analytical skills, as well as exposure to dealmaking and investment processes.

- Corporate Strategy or Business Development: Experience in corporate strategy or business development roles can offer insights into industry dynamics, market trends, and strategic planning. These roles often involve working closely with senior executives, providing valuable networking opportunities.

- Entrepreneurship and Startups: For those with an entrepreneurial spirit, starting or working for a startup can be a great way to gain hands-on experience in the early-stage business world. This path provides insights into the challenges and opportunities faced by startups, as well as the dynamics of scaling a business.

Building a Network

Networking is an essential aspect of the VC industry. Building a strong professional network can open doors to potential opportunities and provide valuable insights into the world of venture capital. Here are some tips for effective networking:

- Attend Industry Events: Attend conferences, workshops, and networking events focused on venture capital, entrepreneurship, and innovation. These events provide excellent opportunities to connect with industry professionals and gain exposure to the latest trends and developments.

- Leverage Online Platforms: Utilize online networking platforms and professional groups to connect with like-minded individuals and industry experts. Engage in discussions, share insights, and showcase your expertise to build your professional brand.

- Seek Mentorship: Find a mentor who has experience in the VC industry. A mentor can provide guidance, share insights, and offer valuable connections to help you navigate your career path.

Developing a Personal Brand

In the competitive world of venture capital, developing a personal brand can set you apart from other candidates. Here's how you can build a strong personal brand:

- Publish Thought Leadership Content: Write articles, blogs, or whitepapers on topics related to venture capital, entrepreneurship, or industry trends. Share your insights and perspectives to establish yourself as a thought leader in the field.

- Engage in Industry Discussions: Participate in online forums, discussions, and Q&A platforms focused on venture capital and entrepreneurship. Share your opinions, ask questions, and engage with industry experts to demonstrate your knowledge and passion.

- Build an Online Presence: Create a professional online profile on platforms like LinkedIn, showcasing your skills, experience, and areas of expertise. Optimize your profile to highlight your strengths and make it easily discoverable by potential employers or industry connections.

Conclusion: Embrace the Venture Capital Journey

The world of venture capital offers a wealth of opportunities for those seeking a dynamic and rewarding career. By understanding the diverse roles, qualifications, and skills required in the industry, you can embark on a journey that combines financial acumen, strategic thinking, and a passion for fostering innovation. Whether you aspire to be an investment professional, a portfolio manager, or an entrepreneurial support specialist, the VC industry provides a platform to make a meaningful impact on the business landscape.

Remember, breaking into venture capital requires dedication, perseverance, and a willingness to learn and adapt. Embrace the challenges, leverage your unique skills and experiences, and stay connected to the vibrant community of entrepreneurs and industry leaders. With the right mindset and a commitment to continuous learning, a career in venture capital can be a fulfilling and impactful journey.

What are the key skills needed to succeed in venture capital?

+Success in venture capital requires a unique blend of skills, including analytical prowess, strategic thinking, networking abilities, and industry expertise. The ability to analyze complex data, make data-driven decisions, and identify growth opportunities is crucial. Strong communication and presentation skills are also essential for conveying investment ideas and connecting with entrepreneurs and industry experts.

How can I gain experience in venture capital without prior industry exposure?

+While industry experience is valuable, there are alternative paths to gain relevant skills. Consider pursuing roles in investment banking, private equity, or corporate strategy to develop financial and analytical acumen. Working for or starting a startup can also provide hands-on experience in the early-stage business world. Additionally, networking and mentorship can open doors to potential opportunities and provide valuable insights into the VC industry.

What are the typical career progression paths in venture capital?

+Career progression in venture capital often follows a hierarchical structure. Entry-level roles include investment analysts and associates, who gain exposure to the investment process and develop their skills under the guidance of senior team members. With experience and proven success, professionals can progress to principal and partner roles, taking on greater responsibilities and making critical investment decisions.

How can I stand out as a candidate in the competitive venture capital industry?

+To stand out in the competitive VC industry, focus on developing a strong personal brand. Publish thought leadership content, engage in industry discussions, and leverage online platforms to showcase your expertise and passion. Building a network of industry connections and seeking mentorship can also enhance your profile and open doors to potential opportunities.