Investment Banking Job

The world of investment banking is a dynamic and highly competitive arena, offering an exciting career path for those with a passion for finance and a drive to make an impact in the global market. This article delves into the multifaceted nature of investment banking jobs, exploring the roles, responsibilities, and skills required to excel in this industry. We will uncover the intricate details of this profession, providing an in-depth analysis that will equip you with a comprehensive understanding of the opportunities and challenges within this field.

Unraveling the Complexities of Investment Banking

Investment banking is a specialized sector within the financial industry, catering to the financial needs of governments, corporations, and high-net-worth individuals. It is a dynamic field, characterized by a fast-paced environment and a constant evolution of financial instruments and strategies. Professionals in this domain play a pivotal role in facilitating capital markets activities, such as mergers and acquisitions, initial public offerings (IPOs), and the issuance of debt and equity securities.

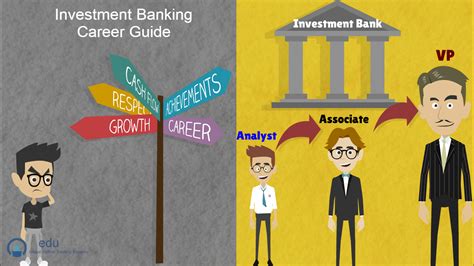

The Diverse Roles within Investment Banking

The beauty of investment banking lies in its diverse range of roles, each contributing uniquely to the overall success of a transaction or strategy. From analysts who provide meticulous research and analysis to support decision-making, to associates who manage client relationships and execute deals, every role is crucial to the smooth operation of the investment banking machinery.

Furthermore, investment bankers often specialize in specific sectors or industries, such as technology, healthcare, or energy. This specialization allows them to develop a deep understanding of the unique dynamics and challenges within these sectors, enabling them to provide tailored financial solutions to their clients.

Key Responsibilities and Skills

Investment banking professionals are expected to possess a unique skill set, combining analytical prowess with excellent communication and interpersonal skills. They must be adept at working with large datasets, interpreting complex financial models, and presenting their findings in a clear and concise manner to clients and colleagues alike.

| Role | Key Responsibilities |

|---|---|

| Analyst | Conducting research, financial modeling, and analysis to support investment decisions. Assisting in the preparation of pitch books and presentations. |

| Associate | Managing client relationships, executing deals, and overseeing the work of analysts. Preparing and reviewing financial documents, and conducting due diligence. |

| Vice President | Leading deal teams, negotiating transactions, and developing new business opportunities. Providing strategic advice to clients and ensuring the smooth execution of deals. |

Additionally, investment bankers must stay abreast of the latest industry trends, regulatory changes, and market developments. This requires a continuous learning mindset and the ability to adapt quickly to new information and strategies.

The Journey to Becoming an Investment Banker

Breaking into the world of investment banking is a challenging yet rewarding endeavor. It typically requires a strong academic background, often with a degree in finance, economics, or a related field. Many aspiring investment bankers also pursue advanced degrees, such as an MBA or a Master's in Finance, to enhance their knowledge and skill set.

Education and Qualifications

While a solid academic foundation is essential, investment banking firms also value practical experience. Many firms offer summer internship programs, providing an opportunity for students to gain hands-on experience and a foot in the door of the industry. These internships often lead to full-time offers, especially for high-performing candidates.

Furthermore, investment bankers are expected to be well-versed in financial regulations and ethical practices. This often involves obtaining relevant certifications, such as the Chartered Financial Analyst (CFA) designation or the Financial Risk Manager (FRM) certification, to demonstrate their expertise and commitment to the profession.

The Hiring Process

The hiring process in investment banking is notoriously rigorous and competitive. Firms typically seek candidates who demonstrate not only strong academic credentials but also a deep passion for finance, excellent problem-solving skills, and the ability to thrive in a high-pressure environment.

The interview process often includes multiple rounds, with a focus on technical assessments, case studies, and behavioral interviews. Candidates are expected to showcase their analytical skills, financial knowledge, and ability to think on their feet. It is also common for firms to assess a candidate's fit within the team and their potential for long-term growth and development.

A Day in the Life of an Investment Banker

The daily routine of an investment banker is varied and demanding. A typical day might involve conducting financial analysis, preparing pitch books and presentations, attending client meetings, and collaborating with colleagues across different departments.

Work Schedule and Workload

Investment banking is renowned for its demanding work schedules, with long hours and tight deadlines being the norm. Professionals in this field often work late into the night and on weekends, especially during critical deal periods. The workload can be intense, requiring exceptional time management and organizational skills.

However, the rewards of this demanding profession are significant. Investment bankers play a pivotal role in shaping the financial landscape, and their work can have a direct impact on the success of businesses and the global economy.

Challenges and Rewards

One of the key challenges in investment banking is the constant need to stay updated with market trends and regulatory changes. The industry is dynamic and ever-evolving, and professionals must be adaptable and quick to learn new skills and strategies.

Despite the challenges, the rewards of a career in investment banking are substantial. Financial incentives are often significant, with competitive salaries and bonus structures. Moreover, investment bankers have the opportunity to work with high-profile clients, gain valuable industry insights, and develop a deep understanding of the global financial market.

The Future of Investment Banking

The investment banking industry is evolving rapidly, driven by technological advancements and changing market dynamics. The rise of fintech and digital banking is transforming the way financial services are delivered, and investment bankers must embrace these changes to remain competitive.

Trends and Innovations

One of the key trends in investment banking is the increasing use of technology and data analytics. Firms are leveraging artificial intelligence and machine learning to enhance their decision-making processes, automate tasks, and gain deeper insights into market trends and client behavior.

Additionally, the focus on sustainability and environmental, social, and governance (ESG) factors is growing within the industry. Investment bankers are increasingly expected to incorporate ESG considerations into their financial strategies and investment decisions, reflecting the changing priorities of clients and investors.

Navigating a Changing Landscape

To navigate these evolving dynamics, investment bankers must be proactive in upskilling and reskilling. Continuous learning and adaptability are essential to thrive in this industry. This may involve pursuing additional certifications, attending industry conferences and workshops, and staying connected with industry peers and mentors.

Moreover, investment bankers must cultivate a client-centric approach, focusing on building strong relationships and delivering tailored financial solutions. As the industry becomes more competitive, the ability to provide exceptional client service and offer unique value propositions will be crucial for success.

Frequently Asked Questions

What are the key skills required for a career in investment banking?

+

Investment banking requires a unique blend of skills, including strong analytical abilities, excellent communication skills, and the ability to work effectively in a team. Proficiency in financial modeling, data analysis, and understanding complex financial instruments are also crucial. Additionally, investment bankers must possess a deep understanding of market dynamics and the ability to adapt to changing industry trends.

How do I break into the investment banking industry?

+

Breaking into investment banking typically involves a combination of academic excellence, relevant work experience, and a strong passion for finance. Many firms value practical experience, so internships and entry-level roles can be a great way to gain a foothold in the industry. Networking and building connections within the industry can also be beneficial in securing opportunities.

What is the typical career progression in investment banking?

+

The typical career progression in investment banking starts with analyst roles, where individuals gain hands-on experience and develop their skills. With time and experience, analysts can progress to associate roles, taking on more responsibility and client interaction. Further advancement may lead to vice president or director positions, where professionals lead deal teams and provide strategic advice to clients.

How do investment bankers stay updated with industry trends and changes?

+

Investment bankers must stay abreast of industry trends and changes to remain competitive. This involves continuous learning, attending industry conferences and workshops, and staying connected with industry peers and mentors. Additionally, many investment bankers pursue advanced certifications and degrees to enhance their knowledge and skills.

What are the potential challenges and rewards of a career in investment banking?

+

A career in investment banking comes with its own set of challenges, including long working hours, intense competition, and the need to stay updated with market dynamics. However, the rewards are significant, including financial incentives, the opportunity to work with high-profile clients, and the satisfaction of making a direct impact on the financial landscape.