Financial Analyst Job Description

The field of finance is an exciting and dynamic industry, offering a plethora of career paths for those with a penchant for numbers, strategic thinking, and a desire to impact business decisions. Among these, the role of a Financial Analyst stands out as a pivotal position, acting as a bridge between data and actionable insights. This article delves into the comprehensive realm of Financial Analysis, exploring its multifaceted nature, the skills it demands, and its pivotal role in the corporate world.

Understanding the Financial Analyst Role

A Financial Analyst is a strategic thinker and decision-making catalyst within a company. They are tasked with interpreting financial data, assessing market trends, and providing recommendations to guide corporate financial decisions. This role demands a keen eye for detail, an analytical mind, and a strong understanding of financial principles.

Financial Analysts play a crucial part in helping businesses make informed decisions, manage risks, and optimize their financial performance. Their work influences various aspects of a company's operations, from investment strategies and budget planning to risk management and performance evaluation.

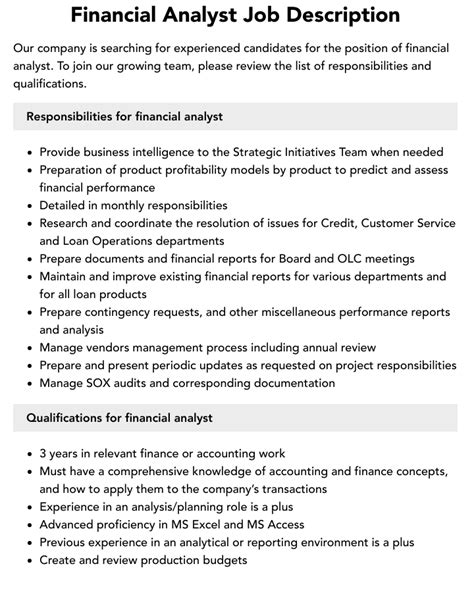

The Responsibilities and Tasks of a Financial Analyst

The scope of a Financial Analyst’s role is extensive and encompasses a wide array of responsibilities. Here’s a detailed breakdown of their key tasks:

Financial Data Analysis and Reporting

At the core of a Financial Analyst’s role is the meticulous analysis of financial data. This involves collecting, cleaning, and organizing financial information from various sources, such as income statements, balance sheets, and cash flow statements. Analysts use this data to generate insightful reports, identifying trends, patterns, and potential areas of concern.

Financial Analysts often leverage advanced software and tools like Excel, SQL, or financial modeling programs to manipulate and analyze data effectively. These reports are then presented to stakeholders, providing a clear picture of the company's financial health and potential opportunities or risks.

Market Research and Trend Analysis

Financial Analysts are not limited to internal data; they also delve into market research and industry trends. This involves monitoring economic conditions, industry-specific developments, and competitor activities. By staying abreast of these external factors, analysts can anticipate market shifts and advise the company on strategic positioning.

For instance, an analyst might identify a shift in consumer preferences or a potential economic downturn, advising the company to adjust its product offerings or financial strategies accordingly.

Investment Analysis and Recommendations

A significant part of a Financial Analyst’s role involves evaluating potential investment opportunities. This could range from assessing the viability of a new product launch to analyzing the financial health of potential acquisition targets. Analysts provide recommendations based on their financial assessments, considering factors like risk, return on investment, and market trends.

In some cases, Financial Analysts might also collaborate with Investment Bankers or Equity Researchers to provide comprehensive investment advice.

Budgeting and Forecasting

Financial Analysts play a pivotal role in budget planning and forecasting. They work closely with various departments to understand their financial needs and constraints, helping to develop realistic and achievable financial plans. Analysts also create financial models to project future financial performance, considering various scenarios and variables.

These models are invaluable for business planning, resource allocation, and decision-making, as they provide a forward-looking perspective on the company's financial trajectory.

Risk Assessment and Management

Identifying and mitigating risks is a critical aspect of a Financial Analyst’s role. They assess potential financial risks, such as market volatility, credit risks, or operational challenges, and provide recommendations to minimize these risks. This could involve diversifying investments, adjusting financial strategies, or implementing risk management policies.

Financial Analysts often work in collaboration with Risk Managers and Compliance Officers to ensure the company's financial practices are compliant and prudent.

Performance Evaluation and Strategy Review

Financial Analysts are responsible for evaluating the financial performance of the company against its set goals and industry benchmarks. They analyze key performance indicators (KPIs) and provide insights on areas where the company is excelling or falling short. This evaluation guides strategic reviews and decision-making, ensuring the company’s financial strategies remain aligned with its objectives.

For instance, an analyst might identify that the company's cost structure is higher than industry averages, prompting a review of operational efficiencies and potential cost-saving measures.

The Skills and Qualifications of a Financial Analyst

The role of a Financial Analyst demands a unique blend of technical skills, analytical prowess, and soft skills. Here’s a closer look at the key skills and qualifications employers typically seek in Financial Analysts:

Education and Technical Skills

A strong educational background is often a prerequisite for Financial Analysts. Most analysts hold a bachelor’s degree in fields like finance, accounting, economics, or business administration. Some employers might prefer candidates with advanced degrees, such as an MBA or a master’s degree in finance or related fields.

In terms of technical skills, proficiency in financial analysis tools and software is essential. This includes expertise in Microsoft Excel (for data manipulation and financial modeling), knowledge of financial databases like Bloomberg or FactSet, and familiarity with accounting software. Additionally, analysts should have a solid understanding of financial principles, accounting standards, and investment strategies.

Analytical and Problem-Solving Abilities

The ability to think analytically and solve complex problems is a cornerstone of a Financial Analyst’s skill set. Analysts must be able to dissect large amounts of data, identify trends and patterns, and draw meaningful insights. They should possess strong logical reasoning skills and be adept at using quantitative methods to interpret financial information.

Problem-solving skills are crucial when dealing with financial challenges or uncertainties. Analysts must be able to propose creative solutions, considering multiple variables and potential outcomes.

Communication and Interpersonal Skills

Effective communication is vital for Financial Analysts, as they often need to present complex financial concepts to non-financial stakeholders. The ability to simplify financial information, create clear and concise reports, and deliver compelling presentations is essential. Analysts should be comfortable interacting with individuals at all levels of the organization, from C-suite executives to department heads and colleagues.

Strong interpersonal skills also facilitate collaboration with colleagues, especially when working on cross-functional projects or with external stakeholders like auditors or investors.

Attention to Detail and Accuracy

Financial analysis is an intricate process that demands precision and attention to detail. Analysts must be meticulous in their work, ensuring that data is accurate and that calculations are error-free. Even small mistakes can have significant implications in the financial world, so a keen eye for detail is non-negotiable.

Time Management and Organization

Financial Analysts often work with tight deadlines, especially when preparing reports or financial models. Effective time management skills are crucial to ensure that projects are completed efficiently and on schedule. Analysts should be able to prioritize tasks, manage their workload, and work collaboratively with others to meet project timelines.

Continuous Learning and Adaptability

The financial industry is dynamic and constantly evolving, with new regulations, technologies, and market trends emerging regularly. Financial Analysts must embrace a mindset of continuous learning, staying updated on industry developments and best practices. They should be adaptable, able to quickly learn new skills, and apply them to their work.

Career Path and Opportunities

The role of a Financial Analyst offers a solid foundation for a rewarding career in finance. With experience and continued learning, analysts can progress into various specialized roles or take on leadership positions within the finance function.

Specialized Roles

Financial Analysts can specialize in various areas, depending on their interests and the industry they work in. Some common specialized roles include:

- Equity Research Analyst: Focuses on analyzing companies and industries to provide investment recommendations to institutional investors.

- Credit Analyst: Evaluates the creditworthiness of individuals or businesses, often for lending institutions.

- Risk Analyst: Assesses and manages financial risks, often working with insurance companies or investment banks.

- Financial Planning and Analysis (FP&A) Analyst: Focuses on budgeting, forecasting, and strategic planning for businesses.

- Investment Banking Analyst: Works with investment banks to provide financial advice and support for mergers, acquisitions, and other corporate finance activities.

Leadership Opportunities

Experienced Financial Analysts can progress into leadership roles, such as Financial Controller, CFO, or Director of Finance. These roles involve overseeing the financial operations of a company or department, providing strategic direction, and managing a team of analysts.

Leadership positions demand a broad understanding of financial principles, strong leadership skills, and the ability to guide and mentor junior analysts.

Conclusion: A Dynamic and Rewarding Career

The role of a Financial Analyst is multifaceted, demanding a unique blend of technical and soft skills. Analysts play a critical role in helping businesses make informed financial decisions, manage risks, and optimize their financial performance. With its blend of strategic thinking, analytical prowess, and practical financial application, the field of Financial Analysis offers a rewarding and dynamic career path for those passionate about finance.

As the business landscape continues to evolve, the demand for skilled Financial Analysts is likely to remain high, making this an excellent career choice for those with a penchant for numbers and a strategic mindset.

What are the typical working hours for a Financial Analyst?

+

Financial Analysts typically work full-time hours, which can range from 40 to 50 hours per week. However, during busy periods or when facing tight deadlines, they might need to work longer hours. This is especially true in roles that involve market analysis or investment banking, where analysts often work on time-sensitive projects.

How does one become a successful Financial Analyst?

+

Becoming a successful Financial Analyst requires a combination of education, skills, and experience. A solid educational foundation in finance, accounting, or economics is essential. Additionally, proficiency in financial analysis tools, data manipulation, and financial modeling is crucial. Soft skills such as effective communication, attention to detail, and critical thinking are also vital for success in this role.

Continuous learning and staying updated on industry trends and developments are key to staying relevant and successful in the field.

What are some challenges faced by Financial Analysts?

+

Financial Analysts often face challenges such as working with large datasets and complex financial models. They must be adept at handling and analyzing vast amounts of data, often under tight deadlines. Additionally, staying up-to-date with changing regulations, economic conditions, and market trends can be challenging, as it requires continuous learning and adaptation.

Are there opportunities for remote work as a Financial Analyst?

+

While remote work opportunities are increasing in many industries, the nature of a Financial Analyst’s role often requires access to sensitive financial data and collaboration with colleagues. Therefore, remote work might be limited, especially for entry-level analysts. However, as an analyst gains experience and moves into more senior roles, there could be more flexibility in working arrangements, including potential remote work options.