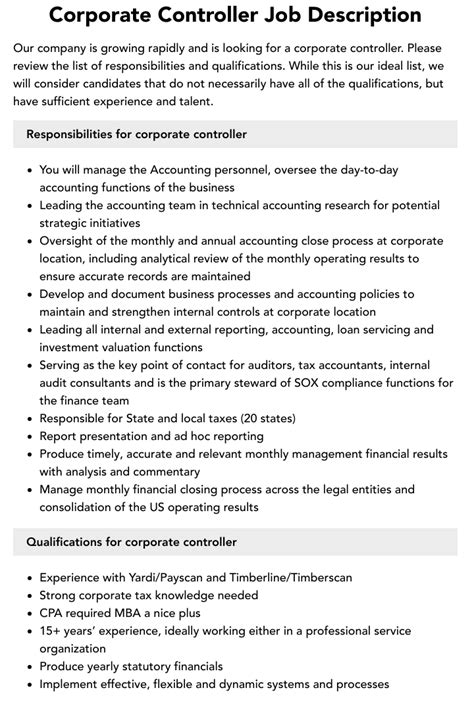

Company Controller Job Description

The role of a Company Controller is a crucial one in any organization, as they are responsible for overseeing and managing the financial operations and health of a company. With a focus on financial accuracy, compliance, and strategic insights, the Company Controller plays a vital role in guiding business decisions and ensuring the long-term financial stability and growth of the organization.

Key Responsibilities and Functions

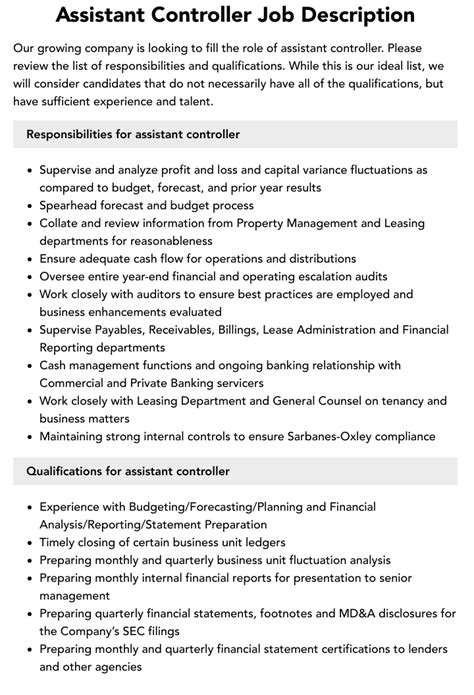

The Company Controller is at the heart of financial management, responsible for a wide range of critical tasks. These include, but are not limited to, financial reporting, budgeting and forecasting, accounting operations, internal controls and compliance, and providing financial analysis and insights to support strategic decision-making.

Financial Reporting

One of the primary duties of a Company Controller is to ensure accurate and timely financial reporting. This involves preparing and presenting financial statements, including income statements, balance sheets, and cash flow statements. The Controller is also responsible for ensuring compliance with accounting standards and regulations, such as GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards), depending on the jurisdiction.

| Financial Report Type | Frequency |

|---|---|

| Monthly Financial Statements | Monthly |

| Quarterly Reports | Every 3 months |

| Annual Financial Report | Annually |

Budgeting and Forecasting

Company Controllers are instrumental in developing and maintaining the company’s financial plans. They collaborate with various departments to create accurate budgets, ensuring they are aligned with strategic goals. Additionally, they forecast future financial performance, helping the organization anticipate and plan for growth, investments, or potential challenges.

| Budgeting Process | Timeline |

|---|---|

| Budget Proposal | Q4 of the previous year |

| Budget Review and Approval | Early in the new fiscal year |

| Mid-Year Budget Review | Mid-year, for adjustments |

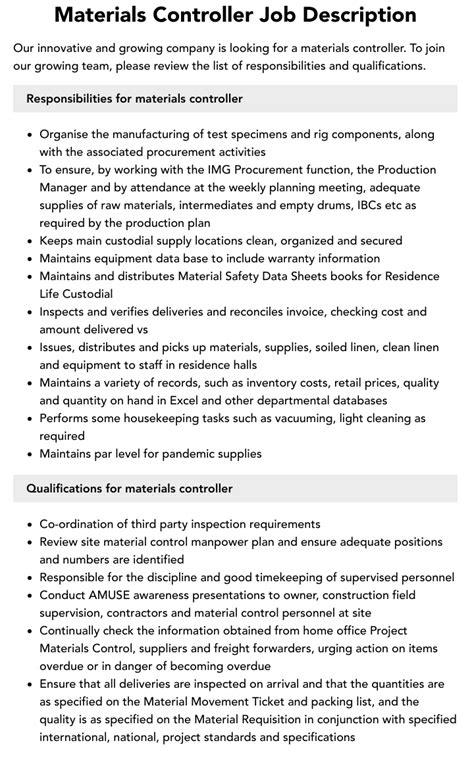

Accounting Operations

Controllers are responsible for the day-to-day accounting functions of the company. This includes overseeing accounts payable and receivable, managing payroll, and ensuring accurate record-keeping. They also supervise and guide the accounting team, providing training and development opportunities to ensure a skilled and efficient workforce.

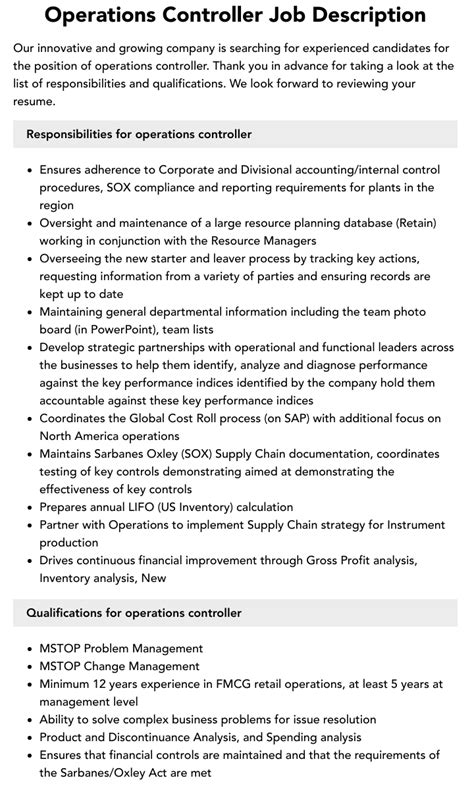

Internal Controls and Compliance

Financial integrity is a cornerstone of the Company Controller’s role. They implement and maintain internal controls to prevent fraud, errors, and misuse of company assets. This includes establishing policies and procedures, conducting internal audits, and ensuring compliance with legal and regulatory requirements. The Controller also ensures the company adheres to tax laws and timely tax payments.

Financial Analysis and Insights

Beyond the numbers, Company Controllers provide valuable financial analysis and insights. They identify financial trends, evaluate the company’s financial performance, and offer strategic recommendations. This role is key in helping the organization make informed decisions about investments, acquisitions, or expansion strategies.

Qualifications and Skills

The ideal candidate for a Company Controller position should possess a unique blend of technical accounting skills, strong leadership abilities, and strategic thinking. Here are some key qualifications and skills to look for:

- Advanced degree in accounting, finance, or a related field, such as an MBA with a finance concentration.

- Certified Public Accountant (CPA) or Chartered Accountant (CA) designation is highly preferred.

- Extensive experience in financial management, with a proven track record in a similar role.

- Proficiency in accounting software and ERP systems, such as QuickBooks, SAP, or Oracle.

- Strong leadership and communication skills, with the ability to guide and mentor a team.

- Analytical mindset, with the ability to interpret complex financial data and present actionable insights.

- Excellent organizational skills and attention to detail.

- Knowledge of financial regulations and compliance standards.

Challenges and Opportunities

The role of a Company Controller comes with unique challenges and opportunities. On one hand, they must ensure the company’s financial operations run smoothly and efficiently. This includes managing financial risks, maintaining accurate records, and staying updated with changing regulations. On the other hand, the Controller has the opportunity to drive strategic financial decisions, influence business direction, and contribute to the company’s long-term success.

Future Outlook

As organizations continue to grow and navigate increasingly complex financial landscapes, the role of the Company Controller will only become more critical. With advancements in technology and the rise of digital finance, the Controller will need to stay abreast of new tools and systems to ensure efficient financial management. Additionally, as businesses expand globally, the Controller’s role in cross-border financial management and compliance will become more prominent.

Conclusion

The Company Controller is a vital member of any organization’s leadership team, responsible for guiding financial strategy, ensuring compliance, and providing valuable financial insights. With a strong foundation in accounting principles and a strategic mindset, the Company Controller plays a pivotal role in shaping the financial trajectory of the business and contributing to its long-term success.

What is the primary role of a Company Controller in an organization?

+The Company Controller oversees and manages the financial operations of a company, ensuring accurate financial reporting, budgeting, and compliance with regulations. They provide financial insights to guide strategic decision-making and contribute to the organization’s long-term financial health.

What are the key qualifications for a Company Controller position?

+Qualifications include an advanced degree in accounting or finance, CPA/CA designation, extensive financial management experience, proficiency in accounting software, strong leadership skills, analytical abilities, and knowledge of financial regulations.

How does the Company Controller contribute to strategic decision-making?

+By providing financial analysis and insights, the Company Controller helps identify financial trends, evaluate performance, and make informed decisions about investments, acquisitions, and expansion strategies. They ensure that financial considerations are integral to strategic planning.