Cash Jobs

The world of cash jobs encompasses a wide range of employment opportunities where payment is received primarily or entirely in cash, outside of traditional banking systems. These jobs often provide quick access to income, particularly for individuals who may not have access to formal banking services or prefer the convenience and anonymity of cash transactions. While cash jobs can offer flexibility and immediate financial gratification, they also come with certain risks and challenges that are important to consider. In this comprehensive guide, we will delve into the various aspects of cash jobs, exploring their advantages, potential pitfalls, and the industries where they are most prevalent.

The Allure of Cash Jobs

Cash jobs appeal to a diverse range of individuals for several compelling reasons. For some, it is the immediate access to cash that is most attractive. Unlike traditional employment where wages are typically paid on a bi-weekly or monthly basis, cash jobs often offer daily or weekly payouts, providing workers with rapid access to their earnings. This can be especially beneficial for those who need money quickly to cover unexpected expenses or immediate financial obligations.

Additionally, cash jobs often come with a level of flexibility that is hard to find in other types of employment. Many cash jobs are part-time, temporary, or project-based, allowing individuals to choose their own hours and work schedules. This flexibility is particularly appealing to students, parents, retirees, and others who may have unique time constraints or commitments outside of work.

Furthermore, cash jobs can provide a sense of anonymity and privacy that is not always possible with traditional employment. In a world where personal information and financial data are increasingly tracked and stored, the appeal of receiving payment in cash, with minimal paperwork or digital footprints, is understandable. This aspect of cash jobs can be especially attractive to those who value their privacy or who, for various reasons, prefer to keep their financial affairs less transparent.

Industries and Job Types

Cash jobs are prevalent across a variety of industries, each offering unique opportunities and challenges. Here are some of the key sectors where cash jobs are commonly found:

Agriculture and Farming

Agriculture and farming are traditional sectors that often rely heavily on cash transactions. From seasonal harvest work to livestock management, many agricultural jobs are paid in cash, particularly for migrant workers or those working on a temporary basis.

Construction and Manual Labor

Construction sites and manual labor jobs frequently operate on a cash basis. Whether it’s a small-scale renovation project or a large-scale construction endeavor, many workers in this industry prefer cash payments for their flexibility and immediate gratification.

Retail and Service Industries

Retail and service industries, such as restaurants, cafes, and shops, often employ individuals on a cash-based system. These jobs can range from waitstaff and bartenders to sales associates and delivery drivers, all of whom may receive a portion of their earnings in cash tips.

Entertainment and Event Industries

The entertainment sector, including music festivals, sporting events, and nightlife venues, frequently employs workers on a cash-only basis. This can include event staff, security personnel, and even artists or performers who are paid for their services in cash.

Domestic and Caregiving Services

Housekeepers, nannies, and caregivers are often employed through private arrangements and paid in cash. These jobs can provide flexibility and immediate income for individuals seeking part-time or short-term work.

Advantages and Disadvantages

While cash jobs offer several advantages, they also come with a set of challenges and considerations that potential workers should be aware of.

Pros of Cash Jobs

- Immediate Access to Earnings: Cash jobs provide quick access to income, allowing workers to receive their pay as soon as the job is completed.

- Flexibility and Convenience: Many cash jobs offer flexible hours and schedules, making them ideal for individuals with unique time constraints.

- Anonymity and Privacy: Cash payments can provide a level of privacy that is not always possible with digital transactions, appealing to those who value discretion.

- No Credit Checks or Background Scrutiny: Many cash jobs do not require extensive background checks or credit verifications, making them accessible to a wider range of individuals.

- Potential for Higher Earnings: In some industries, cash jobs can offer higher pay rates due to the absence of traditional employment overhead costs.

Cons of Cash Jobs

- Lack of Benefits and Security: Cash jobs typically do not offer benefits such as health insurance, paid time off, or retirement plans, leaving workers without the safety net that traditional employment provides.

- Tax and Legal Considerations: Cash payments may not always be properly reported to tax authorities, leading to potential legal and financial complications.

- Risk of Unfair Treatment: Without the protection of employment laws and contracts, cash job workers may be at risk of unfair treatment, wage theft, or exploitation.

- Limited Career Growth and Stability: Cash jobs often lack opportunities for skill development and career advancement, making long-term career growth challenging.

- Dependence on Cash Economy: A reliance on cash payments can limit access to certain financial services and make it difficult to build a credit history or secure loans.

Performance Analysis and Tips

To ensure a positive experience with cash jobs, it is essential to approach these opportunities with a clear understanding of the potential risks and rewards. Here are some key considerations and tips for individuals exploring cash job opportunities:

Due Diligence and Research

Before accepting any cash job, conduct thorough research on the employer and the specific job requirements. Ensure that the job is legitimate and that the employer has a good reputation. Be cautious of jobs that seem too good to be true or involve suspicious activities.

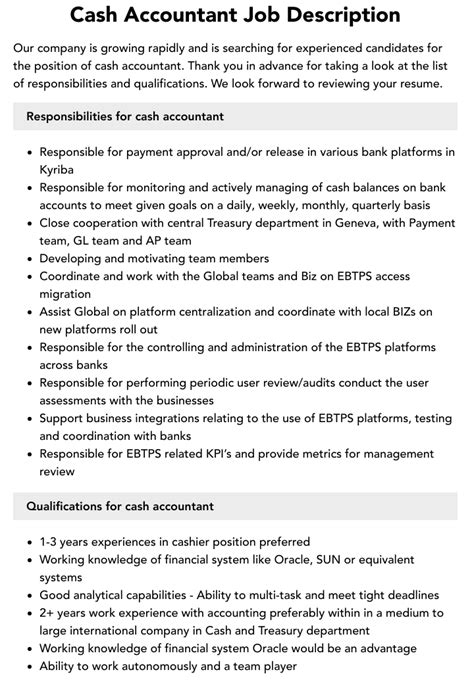

Negotiate Fair Pay

Negotiate your pay rate to ensure it aligns with industry standards and reflects the value of your work. Be prepared to discuss your skills, experience, and the scope of the job to justify your requested rate.

Track Your Earnings

Maintain a record of your earnings, including the date, amount, and any relevant details about the job. This documentation will be essential for tax purposes and can also serve as a reference for future negotiations.

Understand Tax Obligations

Familiarize yourself with the tax implications of cash jobs in your jurisdiction. Ensure that you are reporting your earnings accurately and paying the necessary taxes to avoid legal complications.

Protect Your Privacy

While cash jobs can provide anonymity, be cautious of sharing personal information unnecessarily. Protect your privacy by limiting the details you provide to employers and avoiding online platforms that may compromise your data.

Seek Support and Advice

Connect with other workers in your industry or join relevant support groups to share experiences and seek advice. Building a network can provide valuable insights and support as you navigate the world of cash jobs.

| Industry | Average Cash Earnings |

|---|---|

| Agriculture | $12-18 per hour |

| Construction | $15-25 per hour |

| Retail and Service | Varies widely, often including tips |

| Entertainment | $10-30 per hour, plus potential bonuses |

| Domestic Services | $15-25 per hour, depending on responsibilities |

Future Implications and Conclusion

The world of cash jobs is a dynamic and ever-evolving landscape, influenced by a range of economic, social, and technological factors. As the gig economy continues to grow and the use of digital payment methods becomes more prevalent, the future of cash jobs may see some significant shifts.

On one hand, the increasing popularity of digital payment platforms and mobile banking could make cash transactions less necessary and more traceable. This could lead to a reduction in the number of cash jobs available, as more employers adopt digital payment systems for convenience and security.

However, the demand for certain types of cash jobs may remain strong, particularly in industries where immediate access to cash is crucial or where digital payment methods are less practical. For example, cash jobs in the entertainment industry, such as event staff or street performers, may continue to thrive due to the need for quick payouts and the informal nature of these roles.

Furthermore, the ongoing trend of income inequality and the rise of the gig economy could contribute to an increase in cash jobs as more individuals seek flexible and immediate income opportunities. This may be particularly true for those who are underbanked or lack access to traditional employment opportunities.

As we navigate these changing dynamics, it is essential for individuals considering cash jobs to stay informed about the evolving landscape. Staying up-to-date with industry trends, understanding the legal and financial implications of cash transactions, and being mindful of the potential risks and rewards will be crucial for making informed decisions about cash job opportunities.

Frequently Asked Questions

Are cash jobs legal?

+Yes, cash jobs are generally legal as long as they comply with local labor laws and tax regulations. However, it’s important to understand the legal obligations associated with cash payments, such as tax reporting requirements.

What are the tax implications of cash jobs?

+Cash earnings are generally taxable, just like any other form of income. It’s important to report cash income accurately to avoid legal and financial complications. Consult a tax professional for guidance on reporting cash earnings.

How can I find cash job opportunities?

+Cash job opportunities can be found through various channels, including local classifieds, online job boards, and word-of-mouth referrals. Networking with individuals in your industry or community can also lead to cash job opportunities.

Are there any risks associated with cash jobs?

+Yes, cash jobs can come with certain risks, such as wage theft, unfair treatment, and limited legal protections. It’s important to research employers thoroughly and understand your rights as a worker. Consider joining support groups or seeking advice from experienced individuals in your industry.

Can cash jobs lead to career growth and advancement?

+Cash jobs may not always offer the same opportunities for skill development and career advancement as traditional employment. However, some cash jobs can provide valuable experience and serve as a stepping stone to more stable and lucrative career paths. It’s important to assess your long-term goals and consider the potential for growth within the industry you’re working in.