Bsa Aml Jobs

The BSA AML (Bank Secrecy Act Anti-Money Laundering) field is a critical and rapidly evolving area within the financial industry, focusing on detecting and preventing financial crimes such as money laundering, terrorist financing, and other illicit activities. As regulatory requirements become more stringent and financial crimes grow in complexity, the demand for skilled professionals in this field has surged. This article delves into the intricacies of BSA AML jobs, exploring the roles, responsibilities, skills required, and the impact these professionals have on the financial sector.

Understanding BSA AML Roles

BSA AML professionals play a vital role in ensuring that financial institutions comply with laws and regulations designed to combat financial crimes. These roles are diverse, ranging from analysts and investigators to compliance officers and managers. Each role contributes uniquely to the overall goal of maintaining a secure and transparent financial system.

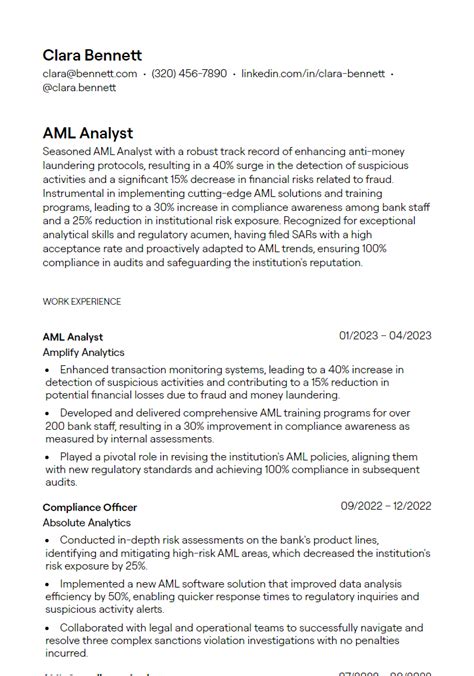

BSA AML Analyst

BSA AML analysts are the front-line defenders against financial crimes. They are responsible for monitoring and analyzing financial transactions for suspicious activities. Using advanced analytics and data mining techniques, these professionals identify patterns and anomalies that could indicate money laundering, fraud, or other illegal activities. They work closely with financial institutions’ transaction monitoring systems to detect and report potential crimes.

A crucial aspect of their role involves staying updated with the latest trends and tactics used by money launderers and fraudsters. This requires a deep understanding of financial regulations, industry standards, and emerging technologies. Analysts must be adept at using specialized software and databases to efficiently process large volumes of data and identify potential red flags.

The work of BSA AML analysts often involves collaboration with law enforcement agencies and regulatory bodies. They assist in investigations, provide expert testimony, and contribute to the development of policies and procedures aimed at enhancing financial crime detection and prevention.

BSA AML Investigator

BSA AML investigators take the analysis a step further by conducting in-depth investigations into potential financial crimes. They are tasked with gathering evidence, interviewing witnesses, and building cases that can be presented to regulatory authorities or law enforcement agencies. These professionals often work on complex cases involving high-profile individuals or organizations suspected of money laundering or terrorist financing.

Investigators must possess strong critical thinking and analytical skills. They need to be able to piece together information from various sources, including transaction data, customer records, and intelligence reports, to construct a comprehensive picture of the suspected crime. This role also requires excellent communication skills, as investigators often interact with a diverse range of stakeholders, including legal teams, law enforcement officers, and financial institution representatives.

Compliance Officers and Managers

Compliance officers and managers are responsible for overseeing and implementing the financial institution’s BSA AML compliance program. They ensure that the institution adheres to all relevant laws and regulations, develops and maintains effective policies and procedures, and provides adequate training to staff members. These professionals are key to ensuring that the institution’s operations remain within the boundaries of legal and ethical standards.

Compliance officers often work closely with other departments, such as legal, risk management, and IT, to ensure a coordinated approach to compliance. They must stay abreast of regulatory changes and industry developments to anticipate and address potential risks. In larger institutions, compliance managers may oversee a team of compliance officers, analysts, and investigators, providing leadership and strategic direction for the BSA AML function.

Skills and Qualifications Required

BSA AML jobs demand a unique skill set that combines financial expertise, analytical prowess, and a deep understanding of legal and regulatory frameworks. Here are some of the key skills and qualifications often sought by employers in this field:

Financial and Regulatory Knowledge

A strong foundation in finance, banking, or a related field is essential for BSA AML professionals. This includes an understanding of financial products, services, and the overall structure of the financial industry. Additionally, a deep knowledge of relevant laws and regulations, such as the Bank Secrecy Act, the USA PATRIOT Act, and international anti-money laundering standards, is crucial. Professionals in this field must stay updated with the ever-changing regulatory landscape to ensure compliance and effectiveness in their roles.

Analytical and Investigative Skills

The ability to analyze complex data, identify patterns, and make sound judgments is critical for BSA AML professionals. They must possess strong critical thinking skills and be adept at using analytical tools and software to process large volumes of transaction data. Investigative skills, including the ability to gather and analyze information, conduct interviews, and build compelling cases, are essential for investigators in particular.

Communication and Collaboration

Effective communication is key in BSA AML roles. Professionals in this field must be able to convey complex financial and regulatory concepts clearly to a variety of audiences, including non-financial stakeholders. They often collaborate with colleagues from different departments and external partners, such as law enforcement agencies and regulatory bodies, so strong interpersonal skills and the ability to work in a team environment are vital.

Attention to Detail and Problem-Solving

BSA AML professionals must have a keen eye for detail to identify subtle indicators of potential financial crimes. They need to be able to recognize anomalies and inconsistencies in data and apply logical thinking to solve complex problems. This skill set is particularly important when dealing with sophisticated money laundering schemes or fraud attempts.

Technology Proficiency

Given the increasing reliance on technology in the financial sector, BSA AML professionals must be comfortable with various software and systems. This includes transaction monitoring systems, data analytics tools, and compliance management software. Staying updated with emerging technologies and their applications in financial crime detection and prevention is essential for staying ahead of the curve.

The Impact of BSA AML Professionals

The work of BSA AML professionals has a significant impact on the financial industry and society as a whole. By identifying and preventing financial crimes, these professionals contribute to the integrity and stability of the financial system, protect consumers and businesses from fraud and financial losses, and support law enforcement efforts to combat organized crime and terrorism.

BSA AML professionals play a crucial role in detecting and disrupting money laundering operations, which can have far-reaching consequences for individuals, businesses, and entire economies. They also assist in the recovery of stolen assets and the prosecution of criminals, ensuring that justice is served and the financial system remains a safe and secure environment for legitimate activities.

Moreover, the expertise of BSA AML professionals extends beyond the financial sector. Their knowledge and skills are increasingly sought after in other industries, such as gaming, sports betting, and cryptocurrency, which face similar challenges in combating financial crimes. As these industries evolve and regulatory environments become more complex, the demand for BSA AML professionals with diverse industry experience is likely to grow.

| Role | Skills | Impact |

|---|---|---|

| BSA AML Analyst | Data Analysis, Transaction Monitoring, Regulatory Knowledge | Early Detection of Financial Crimes |

| BSA AML Investigator | Critical Thinking, Investigative Techniques, Communication | Building Strong Cases for Prosecution |

| Compliance Officer/Manager | Regulatory Expertise, Leadership, Strategic Planning | Ensuring Institutional Compliance and Ethical Practices |

What are some common challenges faced by BSA AML professionals?

+BSA AML professionals often encounter challenges such as the increasing sophistication of money laundering schemes, the need to stay updated with rapidly changing regulations, and the sheer volume of data that needs to be analyzed. They must also navigate complex legal and ethical considerations while maintaining effective collaboration with various stakeholders.

How can one stay updated with the latest developments in BSA AML?

+Continuing education and professional development are crucial in this field. This includes attending conferences, webinars, and workshops, as well as participating in industry associations and networking events. Staying connected with colleagues and subscribing to relevant publications and newsletters can also help stay informed about the latest trends and regulatory changes.

What career advancement opportunities exist in the BSA AML field?

+BSA AML professionals can advance their careers by gaining experience, acquiring additional certifications, and demonstrating leadership skills. With experience, analysts and investigators can progress to senior roles or move into compliance management positions. Specialized certifications, such as the Certified Anti-Money Laundering Specialist (CAMS) or the Certified Fraud Examiner (CFE), can enhance credibility and open doors to new opportunities.