Accounting Clerk 1 Job Description

Unlocking the World of Financial Precision: A Comprehensive Guide to the Role of an Accounting Clerk 1

In the intricate world of finance and accounting, precision and attention to detail are paramount. Enter the Accounting Clerk 1, an indispensable role that forms the foundation of any successful financial operation. This article delves deep into the duties, skills, and impact of an Accounting Clerk 1, shedding light on the often understated but vital work they perform.

The Accounting Clerk 1, often the entry point for many aspiring finance professionals, plays a pivotal role in maintaining the financial health and integrity of an organization. Their work ensures accurate record-keeping, timely transactions, and the smooth flow of financial information, contributing significantly to the overall financial strategy and success of a business.

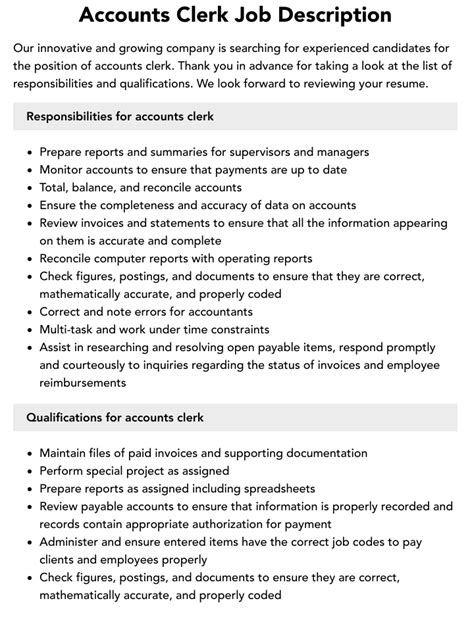

Duties and Responsibilities

The role of an Accounting Clerk 1 is multifaceted and demands a range of skills and abilities. Here's a comprehensive breakdown of their daily duties:

Data Entry and Record-Keeping

At the heart of an Accounting Clerk 1's job is the meticulous entry and maintenance of financial data. They are responsible for ensuring that all financial transactions are accurately recorded, whether it's updating customer accounts, processing invoices, or managing payroll data. This role demands a high level of accuracy and attention to detail to prevent errors that could have significant financial implications.

Transaction Processing

Accounting Clerks 1 are often the first line of defense when it comes to processing financial transactions. This involves a range of tasks, including verifying and posting transactions, reconciling accounts, and ensuring that all payments and receipts are accurately reflected in the financial records. They also play a key role in ensuring compliance with financial regulations and company policies.

Financial Reporting

An important aspect of an Accounting Clerk 1's role is the preparation of financial reports. This includes generating regular financial statements, such as balance sheets and income statements, and ensuring that they are accurate and up-to-date. These reports are crucial for management to make informed decisions and for stakeholders to understand the financial health of the organization.

Customer Service and Communication

Accounting Clerks 1 often interact directly with customers, vendors, and internal teams. They are responsible for addressing inquiries, resolving billing issues, and providing timely and accurate information. Effective communication skills are essential in this role, as they need to explain complex financial matters clearly and concisely to non-financial stakeholders.

Data Analysis and Interpretation

While primarily focused on data entry and record-keeping, Accounting Clerks 1 also play a role in data analysis. They may be tasked with identifying trends, anomalies, or areas for improvement in financial data. This involves using basic analytical tools and techniques to interpret financial information and provide insights that can guide business decisions.

Administrative Tasks

In addition to the core financial responsibilities, Accounting Clerks 1 often handle a range of administrative tasks. This can include maintaining financial records and files, ensuring the security and confidentiality of financial data, and supporting the work of senior accounting staff.

Skills and Qualifications

The role of an Accounting Clerk 1 requires a unique blend of technical skills, soft skills, and educational qualifications. Here's a closer look at the key attributes of a successful Accounting Clerk 1:

Technical Skills

- Proficiency in Accounting Software: Accounting Clerks 1 must be adept at using a variety of accounting software tools, such as QuickBooks, SAP, or Oracle. They should be able to navigate these platforms efficiently and accurately.

- Data Entry and Organization: This role demands exceptional data entry skills, including the ability to enter data quickly and accurately. Strong organizational skills are also crucial for maintaining a well-organized and easily navigable financial record system.

- Financial Knowledge: While a deep understanding of accounting principles is not always required, a basic knowledge of financial concepts, terms, and processes is essential. This includes familiarity with financial statements, accounting cycles, and common financial transactions.

Soft Skills

- Attention to Detail: Accounting Clerks 1 must possess an exceptional eye for detail. A single mistake in financial data entry or processing can have significant consequences, so accuracy is paramount.

- Time Management: With a range of tasks and responsibilities, effective time management skills are crucial. Accounting Clerks 1 must be able to prioritize tasks, meet deadlines, and manage their workload efficiently.

- Communication Skills: As they often interact with various stakeholders, strong communication skills are essential. This includes the ability to listen actively, explain complex financial concepts simply, and convey information clearly and concisely.

- Teamwork: While much of the work is individual, Accounting Clerks 1 often collaborate with other team members, including senior accountants, auditors, and other financial professionals. Strong teamwork skills are essential for a cohesive and effective financial team.

Educational Qualifications

While a bachelor's degree in accounting or a related field is often preferred, many Accounting Clerk 1 positions require a minimum of a high school diploma or GED. However, a growing number of employers are seeking candidates with some post-secondary education or certifications, such as an associate degree in accounting or a professional certification like the Certified Bookkeeper (CB) designation.

Performance Analysis and Measurement

The performance of an Accounting Clerk 1 is typically measured by their ability to maintain accurate financial records, process transactions efficiently, and provide timely and accurate financial reports. Key performance indicators (KPIs) may include:

| Metric | Description |

|---|---|

| Data Entry Accuracy | Measuring the accuracy of financial data entry, often calculated as a percentage of error-free entries. |

| Transaction Processing Speed | The time taken to process financial transactions, including verifying, posting, and reconciling accounts. |

| Report Turnaround Time | The time taken to generate and deliver financial reports, ensuring they are provided in a timely manner. |

| Customer Satisfaction | Assessing the level of satisfaction among customers and internal stakeholders regarding the accuracy and timeliness of financial information and services provided. |

| Compliance Adherence | Evaluating the extent to which the Accounting Clerk 1 follows financial regulations and company policies, ensuring compliance in all financial processes. |

Future Implications and Career Progression

The role of an Accounting Clerk 1 serves as a solid foundation for a career in finance and accounting. With experience and further education, Accounting Clerks 1 can progress to more senior roles such as Accounting Clerk 2 or Accounting Officer, taking on more complex financial responsibilities and strategic decision-making.

For those with an interest in pursuing further education, the Accounting Clerk 1 role can be a stepping stone towards professional certifications like the Certified Public Accountant (CPA) or Chartered Financial Analyst (CFA) designations. These certifications can open doors to higher-level accounting and financial advisory roles, offering increased responsibility and earning potential.

Additionally, with the ever-evolving nature of technology and its integration into the accounting field, Accounting Clerks 1 can explore opportunities in data analytics, financial technology (fintech), or even transition into roles that utilize their financial skills in other industries, such as healthcare or technology.

In conclusion, the role of an Accounting Clerk 1 is a critical yet often understated pillar of the financial world. Their work ensures the accuracy and integrity of financial records, enabling businesses to make informed decisions and navigate the complex landscape of financial management. With dedication, skill, and a passion for precision, Accounting Clerks 1 play an invaluable role in the financial success and stability of organizations.

What are the key differences between an Accounting Clerk 1 and an Accounting Clerk 2 role?

+The Accounting Clerk 2 role typically involves more complex financial tasks and responsibilities. They may handle higher-level transactions, conduct in-depth financial analyses, and take on a more strategic role in financial decision-making. While the Accounting Clerk 1 focuses on data entry, record-keeping, and basic financial transactions, the Accounting Clerk 2 often works closely with senior accountants and financial managers, providing valuable insights and support for strategic financial planning.

What are some common challenges faced by Accounting Clerks 1, and how can they overcome them?

+One of the biggest challenges for Accounting Clerks 1 is maintaining accuracy and efficiency in data entry and transaction processing, especially in high-volume environments. To overcome this, they can utilize effective time management strategies, double-check their work for accuracy, and leverage technology and automation tools where possible. Additionally, staying up-to-date with financial regulations and company policies can help them navigate potential compliance issues.

How can Accounting Clerks 1 contribute to the overall financial strategy of an organization?

+Accounting Clerks 1 play a vital role in providing accurate and timely financial data, which is crucial for strategic financial planning. By ensuring the integrity of financial records, they enable senior accountants and financial managers to make informed decisions, identify trends, and develop effective financial strategies. Additionally, their insights and observations can contribute to identifying areas for cost reduction, revenue growth, or process improvements.