1099 Jobs Near Me

Unveiling the World of 1099 Jobs: Opportunities and Insights

In today's diverse employment landscape, 1099 jobs have emerged as a prominent option for professionals seeking flexibility and autonomy. These jobs, often referred to as "independent contractor" positions, offer a unique path for those looking to forge their own career trajectories. This comprehensive guide aims to shed light on the world of 1099 jobs, exploring their advantages, challenges, and the myriad opportunities they present, especially for those in proximity to your location.

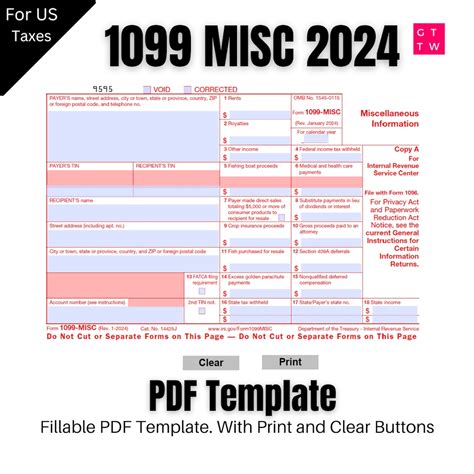

Understanding 1099 Employment

1099 employment is a type of independent contracting where the worker is considered self-employed and responsible for their own taxes and benefits. It's named after IRS Form 1099-MISC, which businesses use to report payments made to independent contractors. Unlike traditional W-2 employment, where the employer withholds taxes and provides benefits, 1099 contractors are responsible for their own tax obligations and typically have more freedom in how they perform their work.

The Advantages of 1099 Work

For many professionals, the allure of 1099 jobs lies in the freedom and flexibility they offer. Independent contractors can choose their projects, set their own schedules, and often work remotely, providing an unparalleled level of autonomy. This flexibility is particularly attractive to those seeking work-life balance or the ability to pursue multiple passions simultaneously.

Furthermore, 1099 jobs can be a goldmine for those with specialized skills. Whether it's graphic design, software development, or consulting, independent contractors can command premium rates for their expertise. This often translates to higher earnings potential compared to traditional employment, especially for those who can secure long-term contracts or multiple projects simultaneously.

| Specialization | Median Earnings (Annual) |

|---|---|

| Web Development | $60,000 - $120,000 |

| Graphic Design | $45,000 - $90,000 |

| Marketing Consulting | $75,000 - $150,000 |

Additionally, 1099 work can provide a platform for career experimentation and diversification. Contractors can easily pivot between industries or roles, gaining a breadth of experience that can be invaluable in today's dynamic job market. This flexibility allows professionals to continuously upskill and stay relevant, ensuring they remain competitive in their respective fields.

Navigating the Challenges

While 1099 jobs offer numerous benefits, they also come with their fair share of challenges. One of the primary concerns is the lack of traditional employment benefits. Independent contractors must manage their own healthcare, retirement plans, and other perks typically provided by employers. This requires a high level of financial literacy and proactive planning to ensure long-term security.

Another challenge is the inconsistency of work. Unlike salaried employees, contractors may experience periods of slow business or a lack of projects. This can lead to financial instability and the need for careful financial management. However, many contractors mitigate this risk by diversifying their client base and continuously marketing their services.

Furthermore, the legal and tax implications of 1099 work can be complex. Contractors must stay abreast of tax laws and regulations to ensure they're compliant. This often involves regular consultations with tax professionals and a keen understanding of business finance. The risk of misclassification as an employee, which can lead to significant legal and financial penalties, is also a concern that contractors must navigate carefully.

Exploring 1099 Job Opportunities Near You

The rise of remote work and the gig economy has made it easier than ever to find 1099 jobs, especially in metropolitan areas. Whether you're a tech professional, a creative, or a consultant, there's a good chance that your city offers a wealth of opportunities tailored to your skills.

Tech Industry Opportunities

Tech hubs like Silicon Valley, Austin, and New York City are known for their abundance of 1099 opportunities in software development, UI/UX design, and IT consulting. These cities attract top talent and provide a fertile ground for independent contractors to thrive. For instance, in Silicon Valley, the demand for freelance developers is high, with many startups and established tech companies seeking flexible talent.

| City | Average Freelance Rate (Hourly) |

|---|---|

| San Francisco | $120 - $180 |

| Austin | $80 - $120 |

| New York City | $100 - $150 |

Even smaller tech-centric cities like Boulder, CO, and Research Triangle Park, NC, offer a range of 1099 opportunities, often at competitive rates. These cities provide a more affordable cost of living, making them attractive options for contractors looking to maximize their earnings.

Creative and Consulting Roles

For creatives and consultants, cities like Los Angeles, Miami, and Chicago present exciting opportunities. These cities are hubs for advertising, marketing, and media, with a constant demand for freelance talent. Whether it's graphic design, copywriting, or consulting services, professionals can find a diverse range of projects to engage with.

| City | Average Project Rate (Per Project) |

|---|---|

| Los Angeles | $3,000 - $6,000 |

| Miami | $2,500 - $5,000 |

| Chicago | $2,000 - $4,000 |

Moreover, with the rise of remote work, many contractors are no longer limited by geographical boundaries. A graphic designer in Seattle can take on projects from New York, and a consultant in Boston can work with clients in Los Angeles. This flexibility allows professionals to expand their client base and find the best opportunities, regardless of location.

Maximizing Your 1099 Career

To make the most of your 1099 career, it's essential to adopt a proactive approach. Here are some strategies to consider:

- Network and Build Relationships: Attend industry events, join professional associations, and leverage online platforms to connect with potential clients. Building a strong network can lead to more opportunities and referrals.

- Diversify Your Skills: Continuously upskill and diversify your offerings. This not only makes you more marketable but also allows you to take on a wider range of projects.

- Master the Art of Self-Promotion: Invest in marketing your services. Build a professional website, optimize your online presence, and utilize social media platforms to showcase your work and expertise.

- Stay Updated on Industry Trends: Keep abreast of the latest trends and technologies in your field. This ensures you remain competitive and can adapt to the evolving needs of the market.

- Manage Your Finances Wisely: As an independent contractor, financial management is crucial. Set aside funds for taxes, invest in your retirement, and consider professional advice to optimize your financial strategy.

The Future of 1099 Work

The future of 1099 work looks promising, especially with the ongoing digital transformation and the increasing acceptance of remote work. As businesses continue to embrace flexibility and talent from diverse locations, the demand for independent contractors is likely to grow. This trend is further bolstered by the rise of freelance platforms and online marketplaces, which provide a global stage for contractors to showcase their skills.

Moreover, the gig economy is expected to expand further, offering more opportunities for professionals to work on their terms. With the right skills, a proactive mindset, and a strategic approach, independent contractors can thrive in this dynamic job market.

What are the key differences between 1099 and W-2 employment?

+The main distinction lies in the worker’s classification and responsibilities. 1099 contractors are self-employed and responsible for their own taxes and benefits, while W-2 employees are considered part of the company and have taxes withheld by the employer, along with receiving various benefits.

How can I find 1099 job opportunities near me?

+You can explore online job boards, freelance platforms, and professional networks specific to your industry. Additionally, attending local networking events and reaching out to businesses in your area can lead to potential opportunities.

What are some challenges unique to 1099 work?

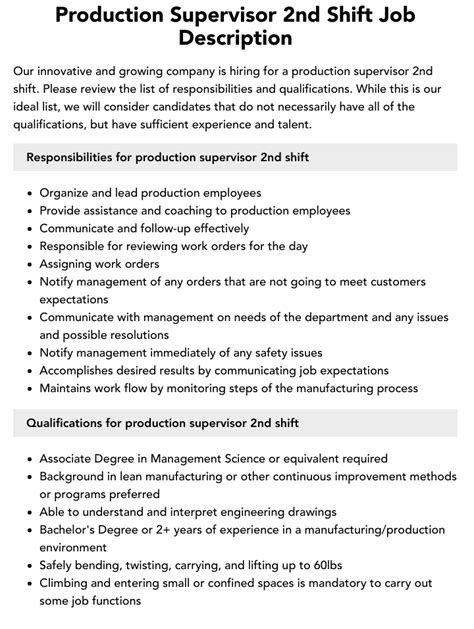

+Independent contractors must manage their own taxes, benefits, and business expenses. They may also face periods of slow work or difficulty finding consistent projects. Additionally, the legal and tax landscape can be complex, requiring careful compliance.